When you’re preparing to invest in real estate, one of the first things you need to make sure to do, before you ever look at a single property, is to reflect on your own personal real estate investing goals.

What do you hope to get out of investing in real estate, and how much do you want to put in, both in terms of time and money?

If you decide that you’re open to giving up some control of your real estate investments in return for fewer active responsibilities, then real estate syndications might be a good fit for you.

As an investor in a real estate syndication, you pool your money together with a group of investors, and you invest in an asset together. In other words, rather than investing in a single-family property on your own and assuming all the responsibilities of being a landlord, you partner together with other passive investors to invest in a commercial real estate property, like an apartment building, together.

But when you’re evaluating a syndication in real estate, where do you start? How can you tell whether a specific property or investment is a good fit for you?

In this article, we’ll walk through one of the key components you should review when evaluating potential syndications – that is, the deal structure, which dictate how the returns in the deal will be split up between you (and all the other passive investors) and the general partners (the team leading the syndication).

Why Different Real Estate Syndications Are Structured Differently

Real estate syndications are like snowflakes. No two deals are exactly the same.

Some real estate syndications offer higher potential returns to investors, along with a healthy dose of risk, while others are more conservative and are structured with more conservative splits to investors.

These differences in the structure of the syndication often have to deal with the personal preferences of the general partners, the track record and experience of the general partners, the markets they’re investing in, the individual property, and where we are in the market cycle, among many other factors.

What this means for you as a passive investor is that, before you invest in a syndication, regardless of the market, asset class, and sponsor, it’s important to examine the structure of each commercial real estate syndication, to ensure that it aligns with your investing goals.

Let’s take a look at two common real estate syndication structures. We’ll examine the breakdown of returns in each type, what investors need to know about each, and how to determine which is the right fit for you.

Real Estate Syndication Structure #1: Straight Split

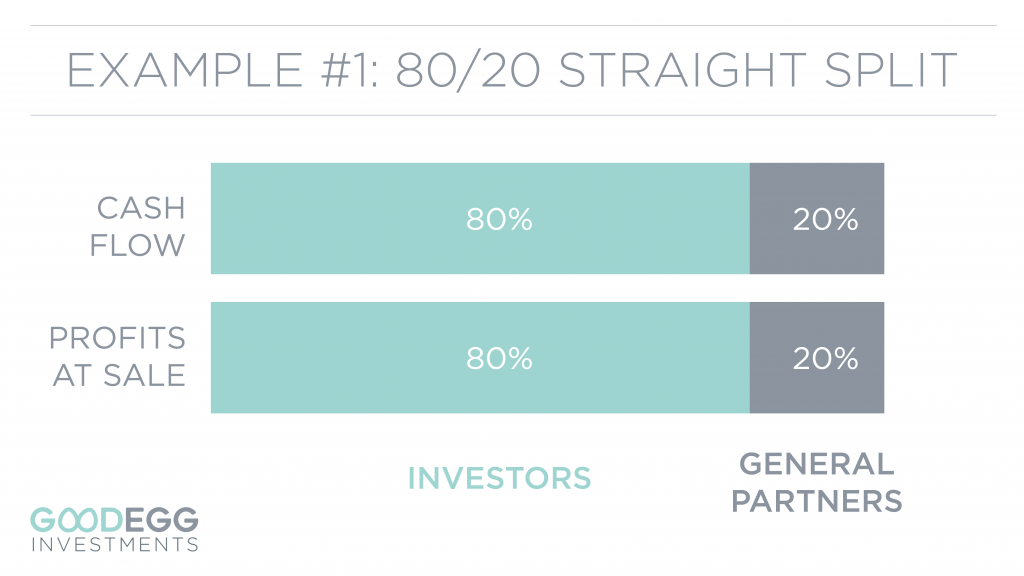

Let’s start with a straight split. This is probably the easiest real estate syndication structure to understand. As the name would suggest, this deal structure uses the same split across the board, for all returns – cash flow, as well as any profits from the sale of the asset.

For example, if a deal uses an 80/20 split, that means that 80% of all returns (cash flow and profits from the sale) go to the limited partner investors (i.e., the group of investors who have invested passively in the deal), and 20% goes to the general partners (aka, the deal sponsors – the ones who syndicate real estate deals).

This is the same, whether there’s $1 or $100,000 in returns. In a real estate syndication deal with an 80/20 split, the passive investors get 80% of the returns across the board, and the general partners get 20% for their role in syndicating real estate.

This deal structure can be especially beneficial to passive investors in deals with high returns. More on this in a bit.

Real Estate Syndication Structure #2: Waterfall Structure

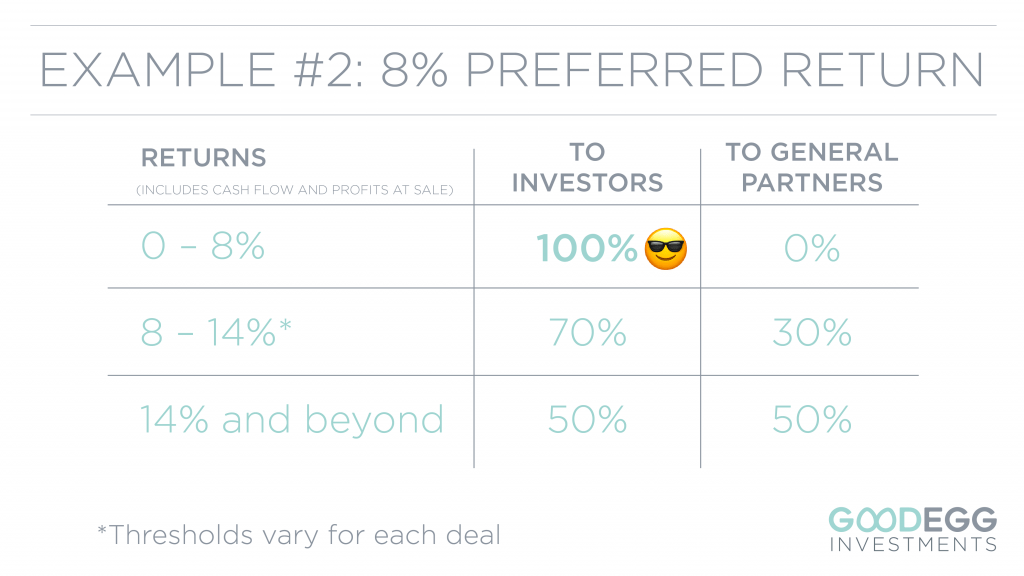

Another common real estate syndication structure is the waterfall structure, which often utilizes a preferred return, or “pref,” which many investors love.

If a syndication includes an 7% preferred return, that means that the first 7% of the returns (cash flow or profits from sale) go directly to you and the other limited partner investors.

That is, the investors get 100% of the first 7% of returns. The general partners only get a piece of the returns if the returns are above 7%.

Preferred Return Example

Let’s say you invest $100,000 into a real estate syndication with an 7% preferred return. The first year, the returns are 7%. That means that investors get the full 7% pref; in other words, you would get $7,000, or 7% of your original $100,000 investment. The general partners don’t get any piece of that.

While this doesn’t guarantee that you will receive the full 7% in returns, it ensures that you get preferred treatment for the first 7% of returns. And, it lights a fire under the general partners to ensure that they’re working hard to get those returns above and beyond 7%.

What Happens Beyond The Preferred Return

So what happens once that 7% threshold is reached?

In the waterfall model, the next few percentage points worth of returns activates a different split for the property. For example, any returns between 7% and 14%, say, might go to a 70/30 split – 70% to limited partner investors and 30% to the general partners.

Once you hit the 14% threshold in this example, the split may change again, perhaps this time to a 50/50 split. This use of different thresholds, or gates, is why this model is often referred to as a waterfall structure.

The waterfall structure is often a win-win, as it’s a great alignment of interests. The general partners wouldn’t take on a property unless they were fairly confident it could produce returns above and beyond the pref. And, the general partners are incentivized to work as hard as they can on behalf of the property and your investment to make the asset perform as well as possible.

The better the property performs, the more you get paid AND the more the general partners get paid.

If the general partners are only able to return low or modest returns, most of those returns go to the investors. However, if the general partners work hard, as they should, then everyone wins. The investors get their pref, plus some extra on top. The higher the returns, the more the general partners get rewarded for their efforts.

Which Real Estate Syndication Structure Is Better?

Of course, there’s no single real estate syndication structure that reigns supreme above the rest. There are many factors to consider, including risk, opportunity to add value to the property, the strength of the property management team, length of the hold, goals of the investment, and more.

Many investors love the preferred return, as it provides a safety net, of sorts, and is the closest thing to a guaranteed return that you will get in an investment.

However, a preferred return does take a more conservative approach, and, as such, may deliver more conservative returns, depending on the particular asset.

Times When The Waterfall Structure Is Better

Let’s say an investment returns right around 10% each year for five years. In this case, which real estate structure would be better for investors?

For this property, the one with the preferred return might be more favorable for investors, since the majority of those cash-on-cash returns would go to the limited partner investors.

For a $100,000 investment returning 10% per year, the straight split would give you 7% of $10,000, or $7,000.

With a preferred return structure, on the other hand, that same 10% would give you 100% of $8,000 + 70% of $2,000, or $9,400.

Times When The Straight Split Is Better

However, let’s take a look at when the returns are higher. Specifically, at the sale of the asset.

The straight split can be especially powerful when the profits at the sale are high. For example, on a profit of 50% at the sale, a straight split on a $100,000 investment would get you 80% of $50,000, or $40,000.

On the other hand, a preferred return with a waterfall structure would get you 100% of $8,000 + 70% of $6,000 + 50% of $36,000, or $30,200.

With a higher profit at the sale of the asset, investors stand to get a bigger piece of the pie.

Using Your Investing Goals To Determine Which Real Estate Syndication Structure Is Best For You

In the end, when it comes to real estate investing, only you can determine which syndication real estate structure works best for you.

If you’re in it more for the ongoing passive income (i.e., cash flow), a real estate syndication with a preferred return might work better, as you would likely see greater cash flow distributions during the lifecycle of the project. However, with the waterfall structure, you may potentially see smaller returns at the project exit.

If, on the other hand, you are in it more for the potential appreciation and profits at the sale, and you don’t care as much about the ongoing cash flow distributions, you might seek out a real estate investment with a straight split, for the chance at a larger piece of the pie upon project exit.

For example, if you invest with a self-directed IRA account, the straight split might align more with your goals, as you can’t touch that retirement money for a while anyway, so you don’t need the short-term cash flow. If you invest with cash, however, and you’re looking to augment your salary, you might place greater value on those ongoing cash flow distributions.

There is no right or wrong answer, and there’s money to be made through either type of real estate syndication structure. But, when in doubt, circle back to your investing goals, and find a real estate investment with a structure that will help you meet those goals.

Want To Learn More?

So there you have it, investors – two common real estate syndication structures. One uses a straight split. The other uses a preferred return with a waterfall structure.

When you invest in real estate and evaluate potential investments, there are many factors to consider.

There’s no single structure that is “best” or that will guarantee you the highest returns. What’s most important is that you make sure to choose investments that align with your personal investing goals.

It’s important to examine the deal structure and your specific goals and risk tolerance, together with all the other aspects of the investment, including the market, deal sponsor and track record, and business plan.

If you’re interested in learning more, seeing some sample deals, or potentially investing alongside us, be sure to join the Goodegg Investor Club.