Remember when you were a kid and you thought about what it would feel like to have finally “made it”? Everyone has a different definition of what this could mean. Perhaps your definition involves living in a certain suburb, driving a fancy car, or being able to fly Business Class.

In real estate investing, most people would agree that becoming an accredited investor is the first sign that they’ve “made it.”

But what is so special about becoming accredited and why should you work toward checking this box?

In this article I’ll cover the reasons why this financial status is worth pursuing and how to get there. I’ll then lay out the roadmap you can use to reach accreditation and walk down the path with you. This roadmap to accreditation will help guide you through the steps so that you can start progressing through your investing journey more easily.

I’ll cover the following steps to becoming an accredited investor:

- Reasons to become an accredited investor

- Understanding what it means to be an accredited investor

- Increasing your income and net worth

- Implementing specific real estate investing strategies that fast-track your path to accreditation.

- Leveraging your real estate investments to build velocity.

- Enjoying what it means to be an accredited investor

Know Your Why For The Journey

Before we dive into the action steps to get you to accreditation, let’s be sure we’re climbing the right mountain. It helps any journey to understand exactly why you want to get started and commit. You’ll need this motivation during any challenges you may encounter along the way.

Why Should You Try To Become An Accredited Investor?

By setting your goal to become accredited, you are doing two big things for yourself. The first is opening more opportunities for investing, which could mean better deals. Having more options means a higher likelihood for finding a deal that matches your criteria.

Second, by setting the goal of becoming accredited, you are embarking on a path rich in knowledge. To become accredited, you are going to learn a ton about various financial strategies and types of real estate investing along the way. This is not a set-it-and-forget-it path. By the time you hit accreditation, you’ll be a super savvy investor and will likely be rewarded for it as you continue your wealth building journey.

Note: While most of the real estate syndications we do are open to accredited investors only, we do occasionally have offerings for all investors. To check if you’re eligible to invest in any of our current offerings, click here.

Mindset Is Everything

It can feel discouraging when you see deal after deal that says “open only to accredited investors” and after doing your research, you realize that you’re not quite there. Trust me we get it, we were all there at one point and we’re here to help.

As you move through this journey toward accreditation your mindset will play a critical role in achieving your goals. By incorporating small mindset shifts into your day to guide you on your path, you’ll be there before you know it.

Try saying this sentence out loud.

“I’m beginning to believe that I can become an accredited investor.”

Doesn’t that roll off the tongue nicely? Believing that you can become an accredited investor is the beginning of your journey. That’s why at every stage we outline in this article, I begin with a new mindset shift statement. Don’t skip this simple, yet profoundly powerful element of each stage.

Want To Invest With Us?

You're invited! Join the Goodegg Investor Club to get access to our open investments and to stay in the loop on upcoming opportunities.

join nowWhat Is An Accredited Investor?

Let’s start with the basics and get some technical definitions out of the way. What does it mean to be accredited? At a high level, an accredited investor is a person or entity that’s allowed to participate in certain securities, or investment, offerings.

Usually, these securities are more complex or sophisticated investment offerings that may not be registered with financial authorities. By requiring investors to be accredited it is assumed that participants are financially savvy enough to fully understand and evaluate the risks of potential investments. In this way, the investors don’t need the protections that come from a registered offering.

These types of exempt securities offerings, which include many real estate syndications, are called private placements.

While some private placements can be open to non-accredited investors (known as “sophisticated” investors) who have a personal connection with the investment leads, most are only open to accredited investors only. It’s simply easier for operators to only offer deals to accredited investors, so more of them chose to structure deals this way.

You’ll see offerings with “506(b)” and “506(c)” exemption status. Accredited individuals can easily invest in both, while Sophisticated individuals can only invest in 506(b) if they meet certain criteria.

You may have guessed it, but there are a whole lot more options for 506(c) real estate investment offerings than 506(b).

Related Blog Post : What Is An Accredited Investor And What Does It Mean For You?

Are You An Accredited Investor?

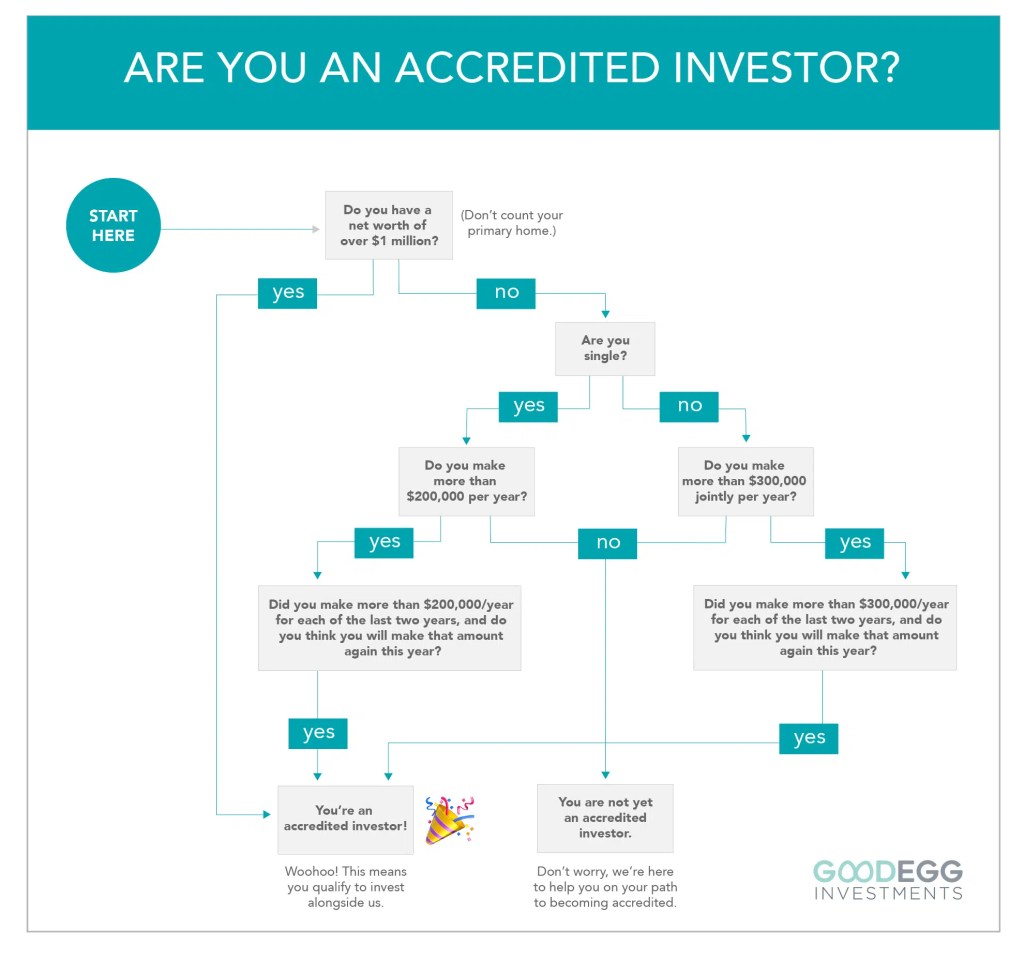

Criteria #1: Net Worth

One way to become classified as an accredited investor is via your net worth. If you have a net worth of at least $1 million, not counting your primary home, then you’re accredited.

If you reach that $1 million net worth threshold, regardless of what your current income is, you’re considered an accredited investor.

Criteria #2: $200k In Income Over The Last Two Years

If you don’t meet the net worth criteria, you might still be an accredited investor, based on your income. If you make $200k as an individual, or $300k together with your spouse, have done so for the past two years, and intend to continue doing so this year, then you are accredited.

You can become an accredited investor by meeting EITHER the income OR net worth criteria. You don’t have to meet both.

If, after reading the criteria above, you’ve realized that you’re not yet an accredited investor, no worries. That’s where this roadmap comes in handy to help you along the way to becoming accredited.

Increasing Your Net Worth

It can feel overwhelming to know where to start so I’m going to break down the steps. Envision a climb to the top of a mountain, if you will. We’ll break down the steps you could take to become accredited as if we were embarking on a journey up that mountain. As you progress through the stages toward accreditation, that mountain summit becomes more closely in your sights.

I’ll focus on the “increasing your net worth” route to accreditation in this article because you have a lot of control in building your net worth. Growing your income can depend on your industry, your employer, and more elements outside of your control. Increasing your net worth can be faster than increasing your income as well, which helps us reach our goal sooner.

With dedication and perseverance, you will make it to accreditation status!

Stage 1 – Gearing Up For The Climb

The first step is always the hardest, right? But taking that step will pay off, you just have to get started. You know that you’re in stage 1 when you first hear of real estate and passive income on a podcast or from a friend who is living the life you see for yourself. You instinctively know that’s where you eventually want to be.

Without any capital or savings it’s hard to know where to start, which can feel a bit overwhelming. Don’t worry though, the first step can be the hardest but once you decide to change your life, there will be no looking back.

Don’t forget your mindset mantra at this beginning stage, as where you see yourself will have a great impact on where you end up.

“I’m beginning to believe that I can become an accredited investor.”

Where You’re Currently At And Where You Hope To Be

There’s no denying there will be work involved when this is where you’re starting from, so roll up your sleeves and don’t delay in getting started. In this stage you’re most likely around 5-7 years away from accreditation, depending on how motivated you are and how much time you have to allot toward this new venture.

You most likely have around $100-200k in net worth and are looking for a way to put your path to accreditation on the fast track.

Getting Started in Stage 1

In this stage you most likely have more time than capital so finding a way to leverage that time will be the quickest way to grow your net worth.

- Find a mentor – Look for someone who is doing what you eventually want to do. Learn as much as you can about how they got to where they are and how you can follow the same path

- Signup for a real estate investing class or group – Learning from others in your same position. You can help bounce ideas off one another or learn through a program that’s been designed for you.

- Learn how to underwrite deals – Once you have this skill acquired you can offer to help syndicators underwrite their deals while also learning the ins and outs of the business and how deals are done

- Become an expert at a skill that you can offer to partners – Learn a skill that you can offer to a partner who has more money than time and create a partnership; i.e., you do the work, they bring the money. Another way to offer your skills is to become an employee with a sponsor company and qualify as a “knowledgeable employee”. You can read more about this here.

- Educate yourself through books, podcasts, conferences – No need to invent the wheel all over again. Soak up all the information that is already available about how to get started in real estate and start putting that knowledge to work.

Related Blog Post: Best Real Estate Investing Books

Stage 2 – You’ve Reached Base Camp

Congratulations, you’ve moved onto the next step! By putting your desire to become accredited on the forefront of your mind, you are actively working toward that goal. In this power learner stage you’re soaking up every piece of information that you can get your hands on. You’ve decided to dip your toes into the water of real estate and have definitely rolled your sleeves up and are ready to work.

Keeping your “eye on the prize” will allow your mindset to stay focused on your goals.

“I’m becoming aware of different strategies that I can use to get there and different people I can tap to help me get there.”

Getting Started in Stage 2

Real estate is on your mind in this step and finding a way to leverage what you currently have and finding a way to scale is top of mind. With a net worth somewhere around $250-500k this step is all about hustling as you work within the skills that you’ve gained. With around 3-4 years to go until accreditation, keep up the pace and you’ll be there before you know it.

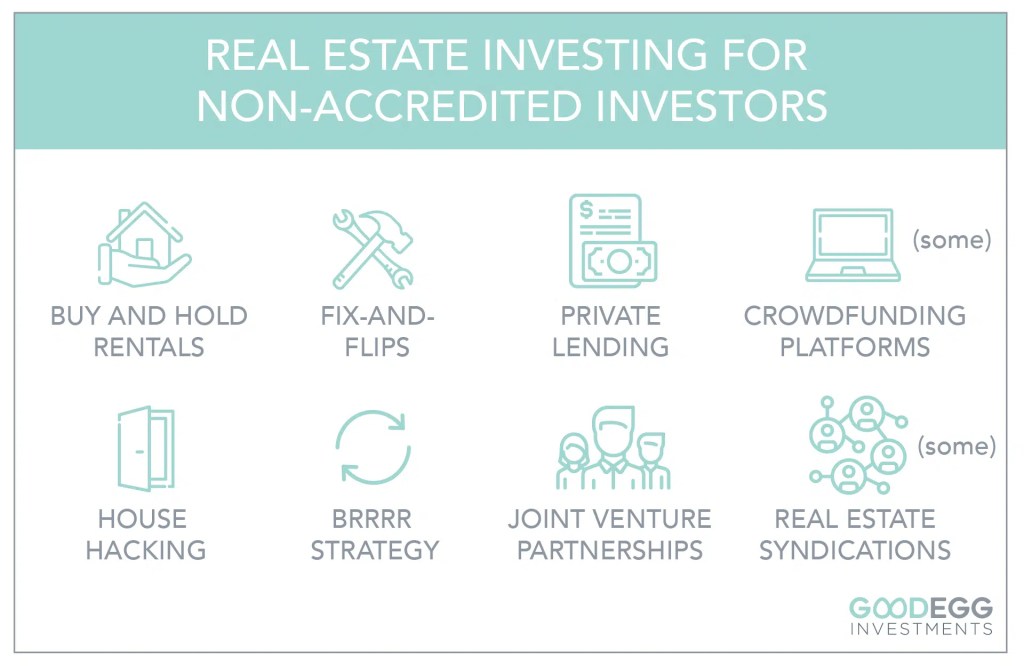

#1 House Hacking

This popular method is a wonderful way to get started in real estate. What better way to learn the ins and outs of the business than by being a live-in landlord. You’ll learn what works for you and what doesn’t as a landlord all while getting your renters to pay most or all of your mortgage. House hacking can work well with a single family home or a duplex. Make note though, if you have a duplex and you live in one portion of it, the primary home unit of the duplex wouldn’t count toward your net worth for accreditation. If you build equity and eventually move out, then the whole property would count.

Related Blog Post: How To Start Living For Free Through House Hacking

#2 Live-in flip

We’ll cover larger fix-and-flips in the next stage but to get started you can consider a live-in flip. Because you’ll be living there during the construction this step can be a bit more cumbersome, hence why it comes earlier in the path. However this is where you can really learn the ins and outs of flipping, real estate management and general ideas on how to build equity in a property.

#3 Take out a HELOC

If you have significant equity built up in your personal home, consider a strategy like taking out a home equity line of credit (HELOC), which essentially allows you to borrow against your own assets to further invest in the real estate market. You can then put some of those HELOC funds into another cash-flowing asset, and now your money is not only working for you but is starting to clone itself.

This is essentially a loan so there is interest to consider. Make sure the numbers make sense when you average the payment. Always run the numbers to make sure this path works for your overall goals.

#4 Wholesaling

Wholesaling is when you find a deal and get it under contract for a low price. Then, while the asset is under contract (i.e., you haven’t completed the purchase yet), you wholesale it to another buyer for a higher price. You pocket the difference and move onto the next one. This is a great way to get your feet wet in how to find and vet good deals.

This is also a great strategy to meet others in the industry and to start finding ways to help them out. You can build relationships with other investors and real estate professionals that will come in handy down the road.

#5 Build Retirement Savings

Since retirement funds count toward net worth, socking away as much as possible is a good move as that will continue building over time. If your employer offers a 401(k) matching program you will definitely want to take advantage of this. Not only is it always a good idea to do this (free money!), it can become especially powerful over time as that match is also helping build your net worth.

#6 Real Estate Crowdfunding Platforms

Investing in real estate through REITs (Real Estate Investment Trusts) or crowdfunding sites is a way to place your money in real estate that may not have the same restrictions as a 506c deal. To be clear, a lot of the crowdfunding sites ARE limited to accredited investors, but there are some sites and some deals that are open to non-accredited investors.

While REITs don’t give you the benefits of direct ownership, they are a vehicle for passive real estate investment, and they typically come with very low minimum investments, sometimes as low as a few hundred dollars.

Related: Real Estate Crowdfunding Sites for Non-Accredited Investors

Reminder: To check if you’re eligible for any of our current offerings, click here.

#7 Invest In A Short Term Rental

Purchasing a property, usually a single-family home and renting it out on a site like AirBnB, VRBO or another short term rental site can be a great way to earn potential income while also building equity in a real estate asset. You can manage this yourself or you can hire a specialized property management company if you don’t have the time it takes to manage the property and guest relations.

You can also creatively combine house hacking (strategy #1) with short term rental by renting your house out while you travel. This could be done for as short as a weekend or as long as several months. Local permits are typically more favorable to primary residence owners who are looking to use their homes as a short-term rental (i.e. there are more available or allow you to rent your house out for more days per year). Of course, you’ll want to be sure you aren’t spending more to live somewhere else!

Check Out Our Open Investments

Want to invest alongside us? Take a look at some of our current and upcoming offerings.

see open dealsStage 3 – Active Trekker

Action is the name of the game in step #3 as you begin to embody the phrase Can’t Stop, Won’t Stop. Taking all that knowledge you’ve acquired, you’re ready for bigger action. Watch out world, here you come!

Having a net worth of around $500-800k you are looking at potentially a short 1-3 years until accreditation. You’re now in super charge mode while leveling up to some exciting steps. Your mindset is continually on the goal you’ve set for yourself.

“I’m allowing myself to make mistakes along the way so that I can become an accredited investor because I deserve to live a meaningful and intentional life by design!”

Super Charged Ideas For Building Net Worth Quickly

Poised and ready to build your real estate empire, you’re still short on that net worth piece of accreditation. However what you have gained over time is a bit more capital and a lot more knowledge. With that additional capital built up over time there are now more possibilities open along your journey.

#1 Fix And Flips

With the additional capital that you have available to you, investing in a fixer upper can be a great move. If you’re willing to be a very hands-on real estate investor and are looking for a short-term investment, a fix-and-flip could be a great option for you.

#2 BRRRR Strategy

BRRRR – Buy, Rehab, Rent out, Refinance, and Repeat – is where you buy a property in need of some love, and you go in and renovate it (either yourself or with a trusted team). Then, you refinance it and pull out some or all of your initial capital (because now that the property has been renovated and rented out, its value is likely higher than when you purchased it). With the money you pull out, you repeat the process with another property. The BRRRR strategy can be an extremely powerful tool for building wealth, whether you’re an accredited investor or not.

#3 Buy-And-Hold Rental Properties

Start by purchasing a small rental property investment, typically a single-family home, and rent it out. If you’re willing to be a little more hands-on, maybe you handle the property management yourself. If you’d rather be more hands-off, you can hire professional property management. Then repeat this process over and over until you build your real estate portfolio of cash flowing assets to a desirable size.

#4 Invest In Turnkey Properties

When you have more capital than time a turnkey property is a great choice. You can enjoy the benefits of owning real estate without spending too much time on managing or fixing it up. This is a slower path to gain net worth but slow and steady can win the race.

#5 Find A Syndication That Takes Non-Accredited Investors

There are real estate syndications that take non-accredited investors, these are 506(b) offerings. Because of regulations put in place by the SEC there are different rules on how deals can be put together when including non-accredited investors. Take the time to research and vet the deals just like you would any other investment and these deals could lead you on the path to wealth with very minimal on-going time commitment (i.e. no landlording).

Related Blog Post: Non-Accredited Investing: You Don’t Have To Be An Accredited Investor To Invest In Real Estate

Stage 4 – Professional Climber Status

Can you feel it? You’re so close. Accreditation can be right around the corner for you and with some minor optimizations to your current portfolio, you’ll be there before you know it. Net worth at this stage is usually around $800-999k and within a year or so you could finally reach that final stage to accreditation. You’ve most likely moved into a place where you have more capital to deploy than time to spend.

This stage should be about reflecting on your financial picture overall, optimizing any current investments, and making strategic moves to get over the $1M hump.

“I know with minor optimization I will be accredited within a short amount of time and will fulfill my dreams of living my life by design.”

#1 Fine Tune Your Personal Budget

This is a good time to look at your personal budget and see if you can “trim the fat” from anywhere. By taking a hard long look at where your money is going, you can potentially bulk up your savings to get you over that final hump of net worth. If you haven’t already, employ a budgeting system to make sure you’re aware of where your money is going.

#2 Optimizing Previous Investments

Remember back in Stage 2 when you purchased the duplex? Now could be the time to sell that property and utilize a 1031 exchange into a larger property. Or use the equity that’s been built up to purchase multiple properties. This stage is about optimizing and building upon what you’ve done in the previous stages to leverage that knowledge and capital.

#3 Take A Deep Look At Your Entire Portfolio

This can be the time to take stock of your entire portfolio. Are there areas that could be improved? For example, could you bring down the management expenses at your short term rental to bring in more cash flow, that could in turn be put into your stock portfolio to bulk up your net worth. Making minute changes such as these could help make the last push over the hump.

#4 Learn About Syndications To Prepare For Accreditation Status

This is the perfect time to research and learn about which operators are putting out the deals you want to be part of. Read as much as you can about what deals are out there so that when you’re ready, you can move into a deal with confidence. We would also recommend signing up on multiple sponsors’ lists to start getting to know them and their team.

Check Out Our Track Record Of Success

Curious whether we can actually do what we say we're going to do? Compare projected versus actual returns in all the deals we've exited to date.

download track recordStage 5 – Summit Reached

Congratulations! You are accredited! Welcome to the club! We’re happy you’re here and we can’t wait to invest alongside you.

Just as if you had summited Mount Everest, take some time to enjoy this moment and also reflect on your journey. You’ve worked hard to be here and are most likely a new person now on the other side of this journey. You’ve learned a lot about yourself in this process; you’re stronger than you ever thought possible.

Now get ready for the next steps! You didn’t think the fun was over now that you’re accredited, right? But don’t worry, these steps are easy and will put you right where you need to be to start manifesting your dreams.

- Sign up for the Goodegg Investor Club – We’re obviously biased as to who you should partner with for your first 506(c) investment. However, your first step should be to sign up for an investor club or another sponsor’s investor list. You’ll be able to see and have access to the deals we have open for our accredited investors

- Choose one sponsor and one deal to invest in – There’s no better way to see how it goes until you actually invest in a deal. As you move through the process of investing in the deal, you can see how you like the sponsor, how you like the deal, etc. This will better inform you on how you want to move forward.

- Reflect on your overall portfolio and strategy – Assuming the deal went well, this is a time to reflect on your overall plan. Do you want to continue the more active strategies you’ve used to get to this point, or do you want to divest and roll your money into syndications? While you can’t 1031 directly into a syndication, there are other options in how you can roll the money over. Make sure you speak to your CPA to learn about the tax implications for your specific situation.

- Asset allocation – take a look at where your portfolio is now and dive into the income / equity / tax benefits it generates. Where are the potential weak points (i.e., are you invested too heavily in one market or asset type)? From there, create a vision for the ideal state of where you want to be – how much time/work is involved, cash flow targets, timelines, taxes, etc. Once you have an idea of what balance is in your portfolio, you’ll have a better idea of where you want to go.

- Self-directed accounts – If you’ve built up sizable retirement savings, another way to invest / diversify is to utilize those accounts to invest in syndications. If your retirement accounts are in self-directed accounts or you transfer them to one, you can easily use this strategy.

Related Video: Maximize Your IRA: Invest It in Real Estate with Heather Dreves

Income Requirements to Reach Accreditation

Now that we’ve covered in depth the net worth criteria and how to achieve accreditation this way, let’s dive into the income requirements. This option can take longer so we won’t spend as much time here. Most people find the net worth requirement the one they choose to pursue actively. However there are tweaks that can be done that set you on the path to increasing your income.

As a reminder, the income requirements to become accredited has three parts:

- You make $200k as an individual, or $300k together with your spouse,

- You have done so for the past two years, and

- You intend to continue doing so this year.

If you satisfy all three of these criteria, then you are considered accredited.

I highly recommend you work on increasing your income in conjunction with increasing your net worth. Once you meet the income requirements, you’ll need to continue to meet them for two years prior to using this to qualify as an accredited investor. This shows the importance of working toward this goal at the same time as building your net worth. Plus, with a higher income (and a higher savings rate), you’ll have more money to invest into your net worth.

You can utilize active and passive income toward the income requirements.

Active Income Generation

While working toward your net worth requirements, it’s important not to overlook the ability to raise your income at the same time. Are you working the job that you want? Is there growth potential within that career? Is it time to start thinking about a career change?

If you’re within $10-15k per year of the income requirements for accreditation, this could be a good time to ask your boss about a raise to push you that extra way above the requirement. If you own your own business, this could be a time to scale back on some expenses and look at your owner’s draw in a different light. Could there be some small changes you can make that will put you on the path to a higher income?

Here are some ideas for increasing your income.

- Ask for a raise – If you work a W2 job, the most straightforward way to increase your salary is to ask your boss for a raise.

- Increase value at your current company – Figure out additional responsibilities you could take on to increase your value to the company and thus warrant a pay increase or promotion.

- Seek a promotion within your current company – Inquiry if there are other higher paid open positions in the company that you could apply for or qualify for with some additional work and /or training. This would allow you to stay within the organization but will open up other opportunities that may increase your salary.

- Consider a move to another company – Apply for jobs at other companies; sometimes that can come with a pay boost, or you can use that job offer to renegotiate your current salary / title.

- Consider a complete career change – If you’re in a career or industry that doesn’t seem to have the growth potential that you desire, then consider a career change. Either go to school or learn a new trade that will have a better chance of income growth. This will add time to your path however sometimes that time will be worth it in the long run.

- Start a side hustle – Consider creating a side hustle which highlights your love of all things real estate investing through creating a blog, YouTube channel, or a real estate course. Each of these options could create additional income, all while sharing the knowledge you’re learning about real estate investing.

New To Passive Investing?

Sign up for our free Passive Real Estate Investing 101 course. You'll get 1 email a day for 7 days – everything you need to invest confidently in your first real estate syndication.

sign up nowPassive Income Generation

Even if you’re not yet able to invest in real estate syndications, there are still ways to earn passive income. Passive income can help boost your income toward that requirement for accredited investors so it’s not to be overlooked.

To have truly passive income, it should feel as easy as someone depositing money into your bank account without you having to do anything. A few options are below.

- Invest as a non-accredited investor in a real estate syndication – As mentioned above, you can start investing as a non-accredited investor in real estate syndication. Do your research and due diligence to find the best fit for you and your investing goals.

- Dividend Stocks/Bonds/High Yield Savings Account – Interest is paid out to you during the time period your money is invested in each. The exact percentage will change based on the investment itself.

- Rent Out Your Spare Room / Car / Home – Got a spare room in your home that you’re not using? Live in a city with a car that just sits parked in front of your house? Does your home sit empty while you travel? Consider renting out these items in a peer-to-peer app to earn money easily. As long as you own these things outright or have low payments and you’re able to manage the rental process without too much time spent, then you’ve found a great passive income source.

These are just a few of the options out there to earn passive income. You can choose to focus on just one of these or employ a few to work toward increasing your income. Once you’ve gotten started with passive investments, you’ll see the power of having your money work for you!

Resources For Non-Accredited Investors

As you work your way through this roadmap toward accreditation, we want to offer some resources of companies that can help you along the way. Utilizing these resources can help you move toward your goals more efficiently.

Wealth Clinic – Leisa Peterson of The Mindful Millionaire helps to transform aspiring visionary leaders into financially thriving and fulfilled business owners. Helping coaches, experts and creatives grow and scale businesses that feel just as good on the inside as they look on the outside. Her goal is to ensure your business is structured to attract, serve and delight more of the people you love while providing you with consistent and predictable streams of cash-flow.

Podcast: Developing a Money Mindset for Savvy Investing with Leisa Peterson

The Shred Method – Adam Carroll of The Shred Method guides you step-by-step to optimize your income, eliminate debt & build real wealth in record time. Hundreds of millions of consumers wonder how they’ll ever pay off college, how they’ll be able to afford retirement, how on earth they can make good money and never get ahead. When used consistently and effectively, The Shred Method can alter your family’s financial tree forever.

Podcast: Maximize Your Finances to Shred Debt Faster with Adam Carroll

Master Passive Income – Dustin Heiner of Master Passive Income is helping people quit their jobs by using the power of investing in real estate. The expert team at Master Passive Income strives to teach you everything you need to know to start investing in rental properties and how you can create your own passive income business from scratch.

Podcast: Bringing People Together To Make Investing Better with Dustin Heiner

Next Steps

Here at Goodegg Investments, we have a variety of options for you to help you learn about and invest in real estate so you can take advantage of the cash flow, equity, appreciation, and tax benefits. Below are a few resources to get you started.

Invest Now

If you’re accredited and ready to invest right now, we invite you to check out our open deals page to learn more about our current or upcoming opportunities.

Learn More

If you’re not yet ready to invest but are curious about how all of this works, we invite you to dip your toe in the water with us through our free 7-day email course – Passive Real Estate Investing 101 – or to get a free hardcover copy of our book – Investing For Good.

Connect With Us

If there’s ever anything we can do to help you on your journey, feel free to email us at [email protected] or call / text us at (888) 830-1450.