Leveraging passive real estate investing in commercial real estate assets has long been touted as a tried-and-true pathway to becoming a millionaire and building serious wealth.

However, opportunities rarely arise for early-stage investors, the non-accredited investors, to leverage this type of real estate investment to begin that journey.

The myth here is that you first have to hustle and grind away building your portfolio of self-managed properties. Live the landlord’s life to pay your dues, in other words. The old “put in your time” rationalization.

We disagree.

No one needs to be a landlord to leverage real estate investing in their wealth building journey. There are other options.

Today, we’re going to discuss the newest vehicle that Goodegg Investments is employing to open up real estate investing opportunities to non-accredited investors: SEC’s Crowdfunding Regulation. After all, our mission is to help everyone build wealth, not just accredited investors.

But this is not like the type of real estate crowdfunding you may have seen before, and it’s every bit as powerful as more traditional real estate syndications.

In this article, we’ll share with you what real estate crowdfunding is, how it works, how it compares to other investment vehicles, and much more.

What is Crowdfunding?

Imagine you want to visit several iconic National Parks in the American West for your 2-week vacation this summer. Not hard to imagine. In fact, it sounds quite lovely! However, you don’t want to deal with hours and hours of driving, finding and paying for parking, and constantly eating gas station snacks. You need an alternate mode of transportation.

Luckily, you’ve found a train route that will transport you to each park without the hassles of any driving. You’ll rest easy in the overnight cabins and arrive in the majestic Big Sky Country feeling refreshed and ready to take in the sights.

In this scenario, the train is literally the vehicle that allows you to achieve your goal of visiting the classic National Parks without having to deal with driving yourself.

Crowdfunding is similar to the train in this example. The real estate crowdfunding websites or platforms are the vehicle, or framework, for allowing non-accredited investors (and accredited investors) to invest in real estate syndications with the top operator teams in the country. All while following all the necessary regulations. These platforms also help operators reach new potential investors.

Until recently, that vehicle was only built to allow accredited investors to climb aboard for investing in real estate syndications. Now, the vehicle can accommodate non-accredited investors too.

The crowdfunding regulations – or set of rules laid out by the Securities and Exchange Commission (SEC) – and the technology (platforms or websites) used to facilitate the exchange are the frame of that vehicle. By using this vehicle, an operator can pick up non-accredited investors, allowing them to join in the ride.

So, all aboard!

We also still like the sound of that National Parks train ride, which is an actual vacation package that has been added to our bucket list.

Now, let’s step back and go over why we just recently have started to see Crowdfunding as a vehicle for investing in real estate.

Related Blog: What Is An Accredited Investor And What Does It Mean For You?

Want To Invest With Us?

You're invited! Join the Goodegg Investor Club to get access to our open investments and to stay in the loop on upcoming opportunities.

join nowThe Rise of Crowdfunding: From Donation To Equity Investment

Many people think of Kickstarter, Indiegogo, or GoFundMe when they hear the word crowdfunding. These platforms allow anyone to raise money to fund a project, business, cause, or anything really (like creating an inflatable Lionel Richie head or anti-zombie soap). The creator of the fund can offer tiered rewards for increased donations or other perks to attract supporters.

Crowdfunding began developing momentum in the past decade as a way for larger sums of money to be raised from friends, family, and strangers. However, not all crowdfunds are the same. Far from it.

These early types of crowdfunds are actually funded by donations, not investments.

Donors may receive a product or discount, but they do not have any equity in the business, or assets. Their relationship ends after the transfer of money and/or goods and services. In other words, these early crowdfunding opportunities weren’t investment opportunities.

The Emergence of Equity Crowdfunding

Equity crowdfunding, such as real estate crowdfunding, allows individuals to invest directly in hard assets, like multifamily properties or hotel buildings, as a group. These investors buy actual equity, just as you would if you were to purchase a single-family home to use as a rental property.

This more recent type of crowdfunding is an investment for the participants, not a donation.

Related Blog: Step By Step Guide To Becoming Accredited

What Is Crowdfunding In Real Estate?

Real estate syndications and funds, or group investments, bring together many investors to purchase larger assets that they would not otherwise be able to purchase on their own.

We love this form of passive real estate investment for many reasons – like not having to deal with tenants or landlord responsibilities, the incredible tax advantages, and creating passive income streams to be able to live a life by design (to name just a few).

When individuals invest in crowdfunded real estate investments, they buy shares in the company that owns the physical property, such as a multifamily apartment building or portfolio of hotels. This means they are actual partial owners of the hard assets, or real estate.

This is a huge difference.

They own an actual piece of that investment property because they own a share of the business entity. This is facilitated through crowdfunding platforms, which is just a fancy way of saying a website set up to help connect real estate investors with operators while following all the necessary legal regulations.

This is the exact process used in most real estate syndications. The crowdfunding path is different because a platform (or specific website) is used to follow essential securities rules that protect investors. This is the vehicle we discussed earlier. (Not the one that is going to iconic National Parks, unfortunately.)

Let’s dive into why this Regulation Crowdfunding (Reg CF) vehicle is only just now being used to help other investors leverage real estate in their investment portfolio.

Remember, the big takeaway here is that Reg CF now allows non-accredited investors to enjoy the benefits of real estate investing, such as ongoing cash flow distributions or profits from the sale of a building. Of course, just as with the 506(b) and 506(c) offerings we’ll discuss below, the investors also take on the risk of loss of capital if the operator doesn’t manage the property well.

Related Resource: Start Here To Discover If Passive Real Estate Investing Is Right For You

Why Are Real Estate Crowdfunding Sites Only Recently Available For Non-Accredited Investors?

Even though you may only now be seeing options to invest in real estate through crowdfunding, the rules began coming together back in 2012. That year congress passed the JOBS Act (Jumpstart Our Business Startups). With this legislation, investing in real estate syndications or funds became a whole lot easier for the everyday investor.

Regulation crowdfunding (Reg CF), as it is called by the Securities and Exchange Commission (SEC), was adopted to implement a specific section of the JOBS Act. This is the act that also created the 506(b) and 506(c) rules already used in real estate syndications. The rules for the real estate crowdfunding piece didn’t come together until 2016.

Remember, these SEC rules had to be sorted out to protect you, the investor, from fraud. Eligible companies must follow strict protocols (that are expensive, but essential) to ensure that they aren’t taking someone’s last dime and blowing it on a terrible investment.

What Is A Real Estate Crowdfunding Platform?

Real estate crowdfunding has opened an alternative way to incorporate real estate investments into anyone’s investment portfolio – one that doesn’t involve being a landlord, which we love. Who really wants to spend their time managing tenants, toilets, and termites anyways?

While the new Reg CF rule allows any investor to participate and make an equity investment, the big opportunity is for the non-accredited investors. The real estate crowdfunding platforms are the technology that makes this possible by streamlining costs and helping operators follow regulations that protect real estate investors.

Existing real estate syndication regulations (those 506(b) and 506(c) rules mentioned earlier) have allowed accredited investors to participate in passive real estate investments for years. But opportunities for non-accredited investors were much harder to find. The rules for allowing non-accredited investors to join these group real estate investments are much stricter, which means more expensive to set up the legal structure. These costs often made the deal less profitable and harder to fully fund since they couldn’t be advertised.

Basically, real estate crowdfunding platforms have become vehicle (that train ride) to house the legal structure that allows more investors to participate in passive commercial real estate investments, specifically the non-accredited investor who’d been excluded from many investing options previously.

Check Out Our Open Investments

Want to invest alongside us? Take a look at some of our current and upcoming offerings.

see open deals

How Do I Get Started Investing In A Real Estate Crowdfunding Offering?

To provide a roadmap of the process of investing in a real estate crowdfunding offering, we’ll outline three questions you’ll want to answer.

#1: What Type Of Commercial Real Estate Investments Will Help Me Reach My Goals?

Crowdfunding provides access to commercial (i.e. larger buildings) real estate investment opportunities. This is because it is easier for an individual investor to invest in residential real estate without the help of a larger group.

However, there are many types of commercial real estate. How should you decide which to invest in?

We suggest beginning with looking at why you want to invest in real estate. What do you want to get out of your investments?

Getting started leveraging real estate crowdfunding begins the same way as any passive real estate investor begins – by defining your investing goals and learning about passive real estate investing. We recommend starting with this essential guide to real estate syndications.

From there, create a list of your investing goals.

Perhaps you are looking for long-term growth so that you can build a big nest egg and retire (even earlier than you had anticipated). Or maybe you want to invest in an asset that provides more cash flow right away, helping you to supplement your income and eventually quit your job.

Now, when you look at different asset classes (multifamily apartments, hotels, self-storage, etc.), you can really look for the details within the investment summary to see if they will help you reach your goals. The type of real estate often doesn’t matter as much as the way the deal is structured and the operator’s track record in delivering on their business plan.

#2: What Is The Minimum Amount I Can Invest Through The Real Estate Crowdfunding Platforms?

Look for the minimum amount accepted for any real estate crowdfunding investment opportunity. It should be clearly stated on any platform you use.

For instance, we at Goodegg Investments typically have a minimum investment amount of $10k for our crowdfunded offerings. This is much lower than the minimum we require for our accredited-only offerings, which means that more people can get started investing in real estate sooner.

The amount of money that you are eligible to invest, no matter what the minimum is for an individual real estate investment opportunity, is determined by the Reg CF rulings. Don’t worry, this math will all be taken care of on the platform when you answer your profile questions.

Generally, if either your income or net worth is less than $124,000 (as of 2023), then you can invest up to $2,500 or 5% of your annual income or net worth (whichever is greater) each year. If both your net worth or income is over $124,000 the amount you can invest increases to 10%, but no more than $124,000. Who knew $124,000 would be a magic number here?

Accredited investors aren’t limited to how much they can invest. If you’re unsure whether you are accredited investor or not, take a look at this accredited investor definition overview we put together based on new updates released in 2020.

This investment restriction is due to the inherent risks involved with real estate investing and helps to protect non-accredited investors from losing everything.

#3: Which Real Estate Crowdfunding Platform Is Best For Me?

Finally, keep in mind that that not all real estate crowdfunding platforms (or websites) are the same, or offer the same types of real estate.

Many real estate crowdfunding websites offer investors the opportunity to invest in a “portfolio” of properties. The investment portfolio may be geared toward high-growth (i.e. future appreciation) or high-income (i.e. cash flow), as a few examples.

This may sound familiar.

If you’ve ever invested in a stock market mutual fund through a financial advisor, you likely remember the spectrum of conservative to aggressive investment opportunities. Here, conservative would be akin to more emphasis on capital protection and decent long-term returns whereas aggressive may be targeting high-growth in a shorter time period.

These portfolio sites may serve your needs and help you meet your goals. However, it can be difficult to know much about the underlying assets or business plans within these portfolio. We believe this information should be an essential part of your due diligence (don’t worry, it doesn’t have to take a lot of your time).

It Isn’t Which Platform, But Which Team

Real estate is really about people. The teams that do the work to analyze deals conservatively, acquire them smartly, and manage the properties wisely can make or break your return.

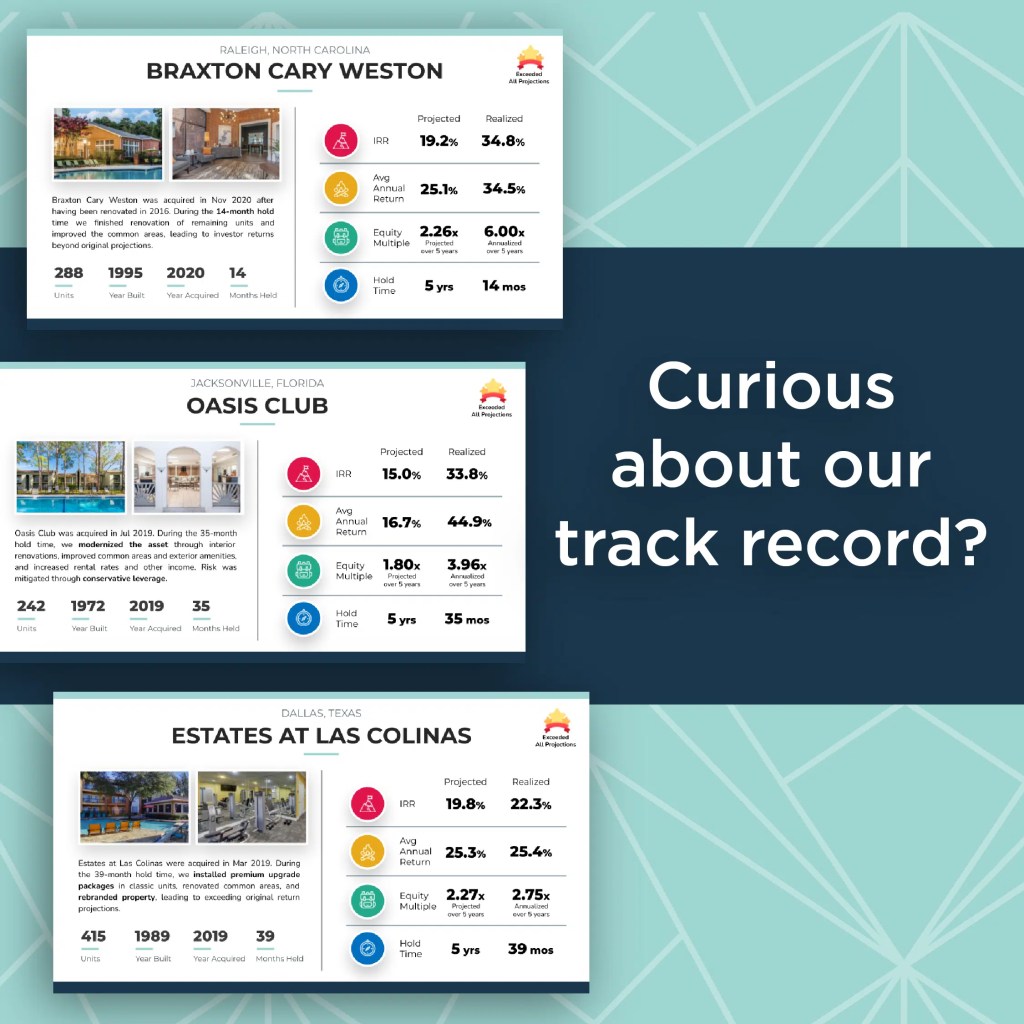

We always suggest potential investors understand the specific real estate project, or deal, and the track record of the team that will be running the investment. This is an essential step to protect your capital.

Hint: A great way to start is to download our Track Record & Case Study and get an inside look at how we’ve done meeting and exceeding the projections for our investments.

We at Goodegg Investments are committed to transparency, exceeding expectations, and thorough investor education. We’ve put together a full case study of our portfolio, so that you can easily understand how our past deals performed. We also aim to answer any investor questions and take the time to meet you 1:1.

Our real estate crowdfunding offerings are no different. We aim to bring this level of passive real estate investing to non-accredited investors so that they can build wealth easier and faster. Real estate crowdfunding sites allow us to lower our minimum investment amount to help more people get their money working in real estate.

Related Video: Goodegg Investments – About Us, Our Team & Our Values

Get Started On Your Next Real Estate Project Today

Crowdfunded real estate can help many more people access the benefits of passive real estate investing. Now, more aspiring investors can leverage the beauty of rental income on a monthly or quarterly basis, reduce their need to pay taxes, and put more energy toward living a life by design.

Interested investors can start by joining our Goodegg Investor Club. We share our real estate crowdfunding opportunities there and all the education you need to make educated investment decisions.

P.S. If you currently own a rental property and are wondering whether you can 1031 exchange into a crowdfunding investment, the answer is – unfortunately not. Not directly, anyway. Learn more here.

Invest Now

If you’re accredited and ready to invest right now, we invite you to check out our open deals page to learn more about our current or upcoming opportunities.

Learn More

If you’re not yet ready to invest but are curious about how all of this works, we invite you to dip your toe in the water with us through our free 7-day email course – Passive Real Estate Investing 101 – or to get a free hardcover copy of our book – Investing For Good.

Connect With Us

If there’s ever anything we can do to help you on your journey, feel free to email us at [email protected] or call / text us at (888) 830-1450.