When it comes to learning new things, my husband and I are complete opposites. He’s a figure-it-out-himself-by-googling-everything kind of guy, and I’m a let-me-sign-up-for-all-the-classes-please kind of gal.

So you can imagine, when I first stumbled across the term “accredited investor,” my first giddy thought was, “Where do I sign up for the class to get my certificate and become accredited?”

No really, that’s what I was thinking. That is, up until I Googled it, and Google laughed in my face.

I quickly realized that there’s no class for becoming an accredited investor. There’s no test to take, no certificate to earn, no professional development credits to hoard. Sigh.

I learned that becoming an accredited investor has to do with either income or net worth, and that there are tons of investment opportunities open to both accredited and non-accredited investors.

In this article, we’ll walk through how to determine whether you’re an accredited investor, what accredited status gets you, and how to invest in real estate, whether you’re accredited or not.

What Is An Accredited Investor?

Let’s start by defining what an accredited investor is. To qualify as an accredited investor, you have to meet at least one of two criteria:

Criteria #1: Net Worth

One way to become classified as an accredited investor is via your net worth. If you have a net worth of at least $1 million, not counting your primary home, then you’re accredited.

If you reach that $1 million net worth threshold, regardless of what your current income is, you’re considered an accredited investor.

Criteria #2: $200k In Income Over The Last Two Years

If you don’t meet the net worth criteria, you might still be an accredited investor, based on your income. If you make $200k as an individual, or $300k together with your spouse, have done so for the past two years, and intend to continuing doing so this year, than you are accredited.

You can become an accredited investor by meeting EITHER the income OR net worth criteria. You don’t have to meet both. Depending on the type of investments you pursue, you’ll either self-report that you’re accredited or be asked to “prove” your accredited status by submitting tax returns and other paperwork.

What Happens If You Are Not An Accredited Investor?

If, after reading the criteria above, you’ve realized that you’re not yet an accredited investor, no worries. There are still plenty of real estate investments available to you, and we’ll cover them in the remainder of this article.

Also, if you’re not an accredited investor and you’re reading this right now, that means you’re light years ahead of where I was when I was a non-accredited investor.

When I was a non-accredited investor, terms like passive income and financial freedom weren’t even part of my vocabulary. I wasn’t looking to build wealth or retire early. I mostly focused on trying to get promotions at work and making sure I was caught up on the latest shows I was watching.

So if you’re not an accredited investor, you’re already on the fast track to financial freedom just by doing this research and considering your investment opportunities. High five. Seriously.

Can Non-Accredited Investors Invest In Real Estate?

All that being said, I know how disheartening it can be to get all excited about financial freedom and to daydream about quitting your job, only to discover that you’re non-accredited and to realize that some private real estate investment opportunities are not open to you.

However, remember that accredited investment opportunities are not necessarily the best or only investment opportunities out there. Rather than focusing your attention on the investments that are NOT available to you, let’s focus on investments that ARE open to you, no matter where you are on your investment journey.

How Can I Invest Without Being Accredited?

Real estate investing is incredibly vast and diverse. There are real estate investments for everyone, especially if you’re willing to go in with an open mind and potentially put in a little work.

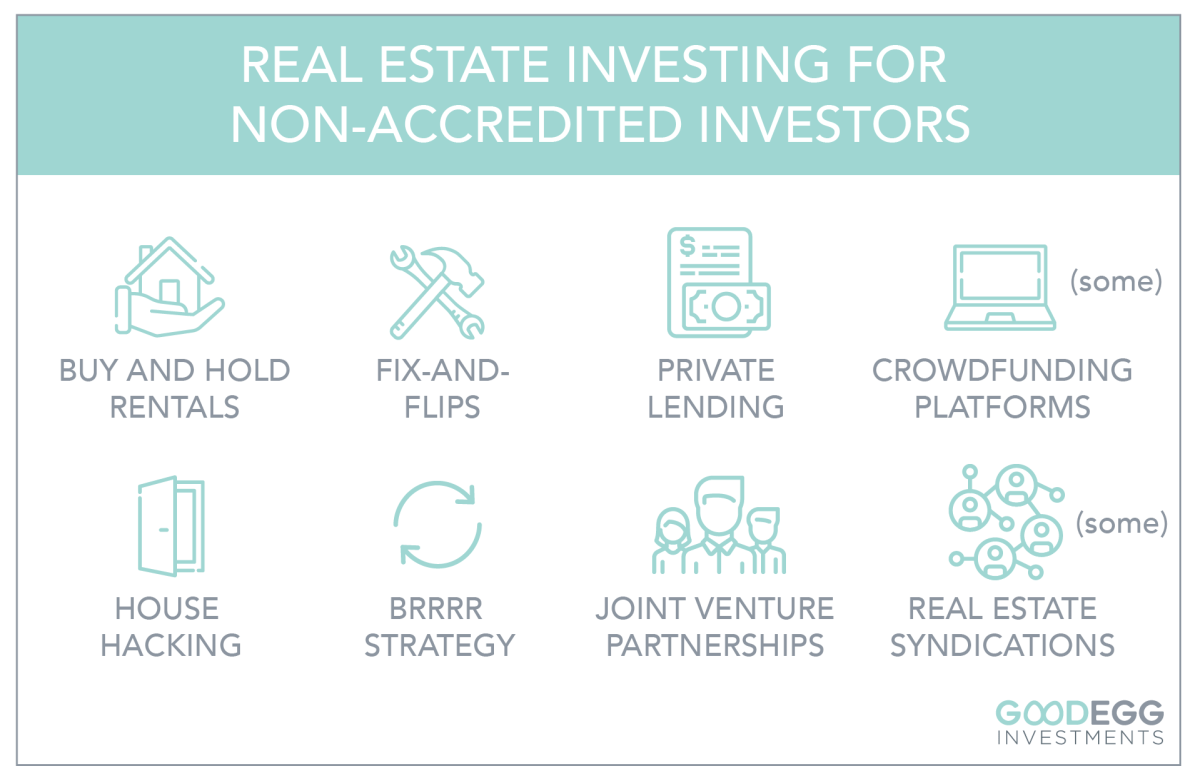

So that’s what we’ll share in the remainder of this article – 8 ways that anyone can invest in real estate and build passive income, whether or not you’re an accredited investor:

- Buy-And-Hold Rental Properties

- House Hacking

- Fix-And-flips

- BRRRR Strategy

- Private Lending

- Joint Venture Partnerships

- Real Estate Crowdfunding

- Private Real Estate Syndications

#1 – Buy-And-Hold Rental Properties

Buying and holding rental properties is one of the methods of real estate investing that’s most familiar to people, whether you’re an accredited investor or not.

You buy a small rental property investment, typically a single-family home, and rent it out. If you’re willing to be a little more hands-on, maybe you handle the property management yourself. If you’d rather be more hands-off, you can hire professional property management.

One of the biggest benefits of rental property investment is that you are in full control. You get to decide on the market, you get to choose the specific property, you get to decide which renovations to do and which tenants to accept.

On the flip side of that, however, is the responsibility. When things go wrong, you are responsible for fixing them or hiring someone to do so.

Buy-And-Hold Rental Properties At A Glance

Open to non-accredited investors: Yes

Level of work: Moderate

Level of risk: Low to Moderate

Timeline: Long-term

#2 – House Hacking

When I first fell into real estate investing, it was when my husband and I bought a duplex in Washington, DC. We lived in the upstairs unit, and we rented out the downstairs unit. We definitely were not accredited investors at that point, though we were on our way with that first investment.

The rent from that downstairs unit helped us pay our mortgage each month, which we thought was just about the coolest thing ever.

Turns out, a few years ago, someone coined a term for this – house hacking – which essentially means that you rent out part of the home that you live in, and you use the rent payments to offset your mortgage.

This can be a fantastic way to get started in real estate investing, especially if you live in a pricier market like San Francisco or New York.

House Hacking At A Glance

Open to non-accredited investors: Yes

Level of work: Moderate

Level of risk: Low

Timeline: Long-term

#3 – Fix-And-Flips

If you’re willing to be a very hands-on real estate investor and are looking for a short-term investment, a fix-and-flip could be a great option for you. You can invest in a fix-and-flip whether or not you’re an accredited investor.

One potential hiccup is that if you live in an expensive market, it could take a LOT of capital to get started. For example, here in the San Francisco Bay Area, you’ll often see tear-downs or properties in need of serious rehab listed for $1 million or more.

This means you would need a lot of money for the down payment, PLUS a good chunk of money for the renovations and the mortgage payments during the renovation period.

Fix-And-Flips At A Glance

Open to non-accredited investors: Yes

Level of work: High

Level of risk: Moderate to High

Timeline: Short-term

#4 – BRRRR Strategy

Have you ever wondered what would happen if buy-and-hold and fix-and-flip got married and had a baby? That’s essentially what the BRRRR strategy is.

BRRRR stands for Buy, Rehab, Rent out, Refinance, andRepeat. The first half of this strategy looks like a fix-and-flip. You buy a property in need of some love, and you go in and renovate it.

The second half of the strategy, however, looks more like a buy-and-hold. Instead of selling the property, you rent it out. Then, you refinance it and pull out some or all of your initial capital (because now that the property has been renovated and rented out, its value is likely higher than when you purchased it).

If you are able to pull out all of your original capital, you would essentially be making infinite returns on the property.

Then, with the money you pull out, you repeat the process with another property.

The BRRRR strategy is an extremely powerful tool for building wealth, whether you’re an accredited investor or not.

BRRRR Strategy At A Glance

Open to non-accredited investors: Yes

Level of work: High

Level of risk: Moderate to High

Timeline: Long-term

#5 – Private Lending

When most people think of investing in real estate, they think about the equity side of things. Putting in a down payment to buy a house, then building equity over time.

However, on the other side of the coin is investing in debt. That is, you can loan someone money to, say, do a fix-and-flip. The best part is, you don’t have to be an accredited investor to do so.

Maybe you have a full-time job and don’t have the energy to take on a fix-and-flip yourself, but you meet someone who wants to do a fix-and-flip but doesn’t have the capital to get started.

You could loan them the money for, say, 12 months at 10% interest. Before the 12 months are up, they sell the fix-and-flip for a profit, you earn 10% interest on the original amount you loaned them, and everyone wins. And, because the loan is backed by the property, your risk is relatively low.

Private Lending At A Glance

Open to non-accredited investors: Yes

Level of work: Low

Level of risk: Low

Timeline: Short-term

#6 – Joint Venture Partnerships

If you’re itching to get into multifamily or other commercial real estate investing but are not yet an accredited investor, one way you might break in is through a joint venture (JV) partnership. If you have some capital to invest and skills to contribute, you could be a great potential joint venture partner.

In a joint venture partnership, a small group of people comes together to invest in a property together. Maybe one person does the underwriting, another person deals with the renovations, and another person handles the asset management.

Each person on the team has an active role, so there are no passive investors.

Joint Venture Partnerships At A Glance

Open to non-accredited investors: Yes

Level of work: High

Level of risk: Moderate

Timeline: Depends on the project

#7 – Real Estate Crowdfunding

Have you ever come across real estate crowdfunding platforms? They’re essentially like Kickstarter, but for real estate.

Through these platforms, you can find a variety of real estate projects to invest in, everything from fix-and-flips to large-scale value-add multifamily projects.

As a passive investor in these projects, you invest your capital, then receive a piece of the returns, all without having to do any of the work.

The downside of these platforms, especially for non-accredited investors, is that, due to SEC regulations, many of the opportunities are open to accredited investors only.

However, there are a few real estate crowdfunding sites that offer REITs (real estate investment trusts) for non-accredited investors.

While REITs don’t give you the benefits of direct ownership, they are a vehicle for passive real estate investment, and they typically come with very low minimum investments, sometimes as low as a few hundred dollars.

Here are two real estate crowdfunding platforms that offer opportunities for non-accredited investors: Fundrise’s eREIT and RealtyMogul’s MogulREIT.

Real Estate Crowdfunding At A Glance

Open to non-accredited investors: In some cases

Level of work: Low

Level of risk: Low

Timeline: Long-term

#8 – Private Real Estate Syndications

Real estate syndications are essentially group investments. A group of people come together and pool their resources to invest in an asset together. Now, you may be thinking, that sounds an awful lot like the JV partnership mentioned above.

And you would be right, except that in a syndication, most of the investors are passive investors. There’s a small group of people, the general partners, who have an active role. The rest of the investors are limited partner passive investors (unlike in a JV partnership, where everyone has an active role).

There are a wide array of real estate syndications out there. Many are open to accredited investors only, due to SEC regulations. However, there are some opportunities open to non-accredited investors as well.

How Many Non-Accredited Investors Can You Have In A Real Estate Syndication?

One of the types of opportunities that are open to non-accredited investors are 506(b) deals, are not allowed to be publicly advertised though, so you have to know someone who’s part of the general partnership, in order to invest in that deal.

This is where the digging comes in. If you are not an accredited investor and want to passively invest in a real estate syndication, you’ve got to be willing to go out there and network with people to find deals that will accept non-accredited investors.

A 506(b) real estate syndication investment can have up to 35 non-accredited investors, so if you’re considering a smaller 506(b) syndication investment with just a handful of investors, there should be plenty of room for you, whether you’re accredited or not.

However, on a larger 506(b) investment, even one that’s raising $10 million or more, they are still limited to 35 non-accredited slots, so you’ll need to be ready to jump on these investments as soon as they open up, to secure your spot.

Alternatively, Reg CF (regulation crowdfunding) offerings are also open to non-accredited investors, and while there’s no limit to the number of non-accredited investors a crowdfunding offering can accept, you may be limited by the amount you can invest in the offering, based on your income or net worth.

To see if you’re eligible to invest in any of our current offerings, click here.

Real Estate Syndication Minimum Investment

You should also know that most private real estate syndication investments require a minimum investment of $50k or more, so you’ll want to be sure to build up a net worth of at least several hundred thousand before investing in a syndication. With a crowdfunding offering, the minimum may be lower.

Private Real Estate Syndications At A Glance

Open to non-accredited investors: In some cases

Level of work: Low

Level of risk: Low

Timeline: Long-term

Recap and Takeaways

As previously mentioned, if you’re not an accredited investor and you’re reading this article, serious kudos to you. Just by knowing that you’re not yet accredited and taking the steps to build passive income, you’re already way ahead of the curve.

Many people who start out in real estate investing do so through small rentals, so they often don’t even know what the term accredited means, nor do they need to.

It’s only the people who learn about real estate syndication investments early on in their investing journeys that come across this delineation between accredited and non-accredited and then realize that certain opportunities are closed to them.

But don’t let this get you down. The investments open to accredited investors only are not necessarily the best deals. And often, there are faster and more powerful ways to accumulate wealth through real estate, especially if you’re willing to put in a little work.

In this article, we discussed 8 of the many, many ways you can invest in real estate as a non-accredited investor:

- Buy-And-Hold Rental Properties

- House Hacking

- Fix-And-Flips

- BRRRR Strategy

- Private Lending

- Joint Venture Partnerships

- Real Estate Crowdfunding Platforms

- Private Real Estate Syndications

Want To Learn More?

With our years of real estate investment and syndication experience, we’ve tried pretty much all of these, and we’ve discovered some of the pros and cons of each.

We’re always happy to help you on your investing journey, whether through helping you invest in deals that fit with your investing goals or connecting you with the right people and resources to help you on your way.

To connect with us and to learn more, apply for the Goodegg Investor Club.