When I was growing up, money was scarce. For a good long while after my dad graduated with his PhD in sociology, he had trouble finding a job, so my mom was working double shifts at a local restaurant and nursing home.

My parents bought most of my clothes at garage sales, and we almost never went out to eat. I didn’t know anyone who was rich, had retired early, or didn’t need to work.

But, I do remember the exact moment my mom shared with me that there are some people in the world with enough money that they don’t have to work. At the time, she explained to me, per her understanding, that if you saved up enough money, you could just live off the interest from your bank account and thus never have to work.

While it’s nearly impossible to purely save your way to financial freedom these days (without strategies like investing in real estate, for example), it nevertheless opened my little mind to the possibility that the traditional path – graduating from college, getting a job, climbing the ladder for 40 years, and then retiring at age 65 – might not be the only way to do life.

Fast forward to the moment that I discovered the FIRE Movement, at a personal finance conference just a few years ago. Just as when I was little, I experienced a complete paradigm shift.

For the first time, I realized that the story of financial freedom that my mom had told me could actually become my reality (albeit with some strategic alterations). I realized that there was a clear path I could follow to becoming financially independent, and that there were many others who had been able to reach financial independence and retire as early as in their 20s.

In this article, we’ll share with you what exactly the FIRE Movement is and where it came from, whether it’s right for you and your goals, different types of FIRE, steps to achieving financial independence, how to accelerate your path to FIRE through investing in real estate syndications, and much more.

What Is FIRE?

Let’s start with the basics. FIRE stands for Financial Independence Retire Early. Rather than following the traditional path of working for 40+ years and then retiring in your 60s, the FIRE Movement shows you an achievable path toward creating enough wealth so that you can achieve financial freedom and thus no longer need the income from your work to support your lifestyle and living expenses.

Once you can support your chosen lifestyle through passive income, you are essentially financially free, meaning you no longer need to work.

Side note: Many people who are part of the FIRE Movement and successfully reach FIRE do choose to continue working, though on their own terms, which has led to an alternative meaning for FIRE: Financial Independence Recreational Employment.

Related: Financial Freedom Vs. Financial Independence

Where Did The Term FIRE Come From?

The term FIRE was originally coined in the book Your Money or Your Life, written by Joe Dominguez and Vicki Robin in 1992.

The book opens readers’ minds to the idea of financial independence and creating a life that aligns with your goals and values, rather than spending the best years of your life working a 9-to-5 job.

One of the central ideas in the book is that most of us go through life exchanging our time for money without ever even thinking about it or knowing that there could be another way.

Time, as our most precious resource, is spent earning money, often in a job we might not love, to buy things that may not matter.

Though the seeds of financial independence as a concept were sown through the book, it would take another 25 years or so until the FIRE Movement took hold.

In the years following the Great Recession, many people became disillusioned at the status quo and started questioning the traditional path toward retirement, realizing that traditional financial planning and advice did little to help in the face of a major downturn.

Out of this growing unrest came new thinking and new ideas, including the story of Pete Adeney, aka Mr. Money Mustache, who retired at age 30 through intentionally saving and investing.

Through his blog, as well as the many blogs, books, and stories that emerged, the FIRE Movement was born and started to spread like wildfire.

Check Out Our Track Record Of Success

Curious whether we can actually do what we say we're going to do? Compare projected versus actual returns in all the deals we've exited to date.

download track record

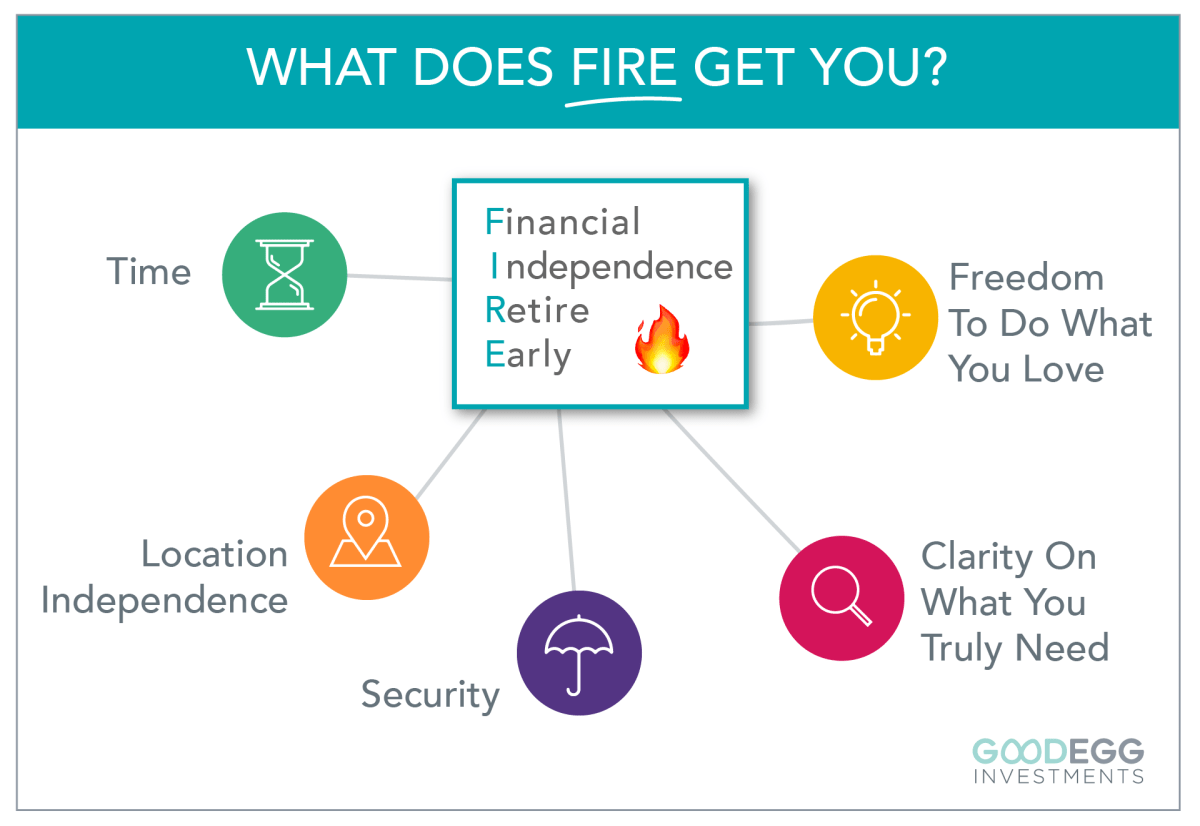

What Does FIRE Get You?

Time

One of the most important things that you get through financial independence and early retirement is your time back, particularly in the prime decades of your life when you’re healthy and your kids are still little.

Once you remove the need to work a 9-to-5 job every day, you can spend more time with your family, discover and pursue more hobbies, and travel the world.

In essence, you get back the most precious resource in your life – your time – so you can create a meaningful and intentional life by design.

Location Independence

If you’re lucky enough to have a remote job where you can work from home or anywhere in the world, you’ve already achieved location independence.

However, if your job requires you to be on site at an office or even within a time zone, that locks you into certain geographies.

Once you achieve financial independence and retire early, you have the freedom to live anywhere in the world, because you will no longer need to work.

Security

When you are dependent on the income from your W-2 job, you put yourself at risk of losing that income at a moment’s notice due to unfortunate and unexpected circumstances like layoffs.

When you achieve financial independence and early retirement, you can rest assured that your nest egg is enough to sustain your lifestyle indefinitely, even adjusted for inflation, and even if you never work another day in your life.

Clarity On What You Truly Need

Because the pursuit of financial independence involves being intentional around your saving and spending goals and habits, the journey forces you to come to terms with the things you truly need versus the things you merely pine after.

Through this process, you’ll discover what truly brings you lasting enjoyment and fulfillment, rather than blindly or unconsciously spending money on things that bring you short-lived joy or perceived status.

Freedom To Do What You Love

When you take away the need to work, you suddenly have the time and ability to do what you want. This can take the shape of what hobbies, side hustles, passion projects, or full-blown businesses.

When you’re dependent on the income from your job, the risk of halting that income to launch a business is huge, especially because that business could throw off very little income or no income for a good amount of time, if not indefinitely.

However, once you’ve gotten the income part taken care of, the risk of starting a new venture is much lower, because you aren’t dependent on that income, and thus the chances of you finding or creating something you love increases significantly.

How To Find Your FIRE Number

The first step in your Fire Movement journey toward financial independence and early retirement involves taking an inventory of where you are and where you want to go.

To do so, start by calculating your FIRE number – the total value of savings and invested assets you need to reach so that the returns / passive income will cover all your expenses.

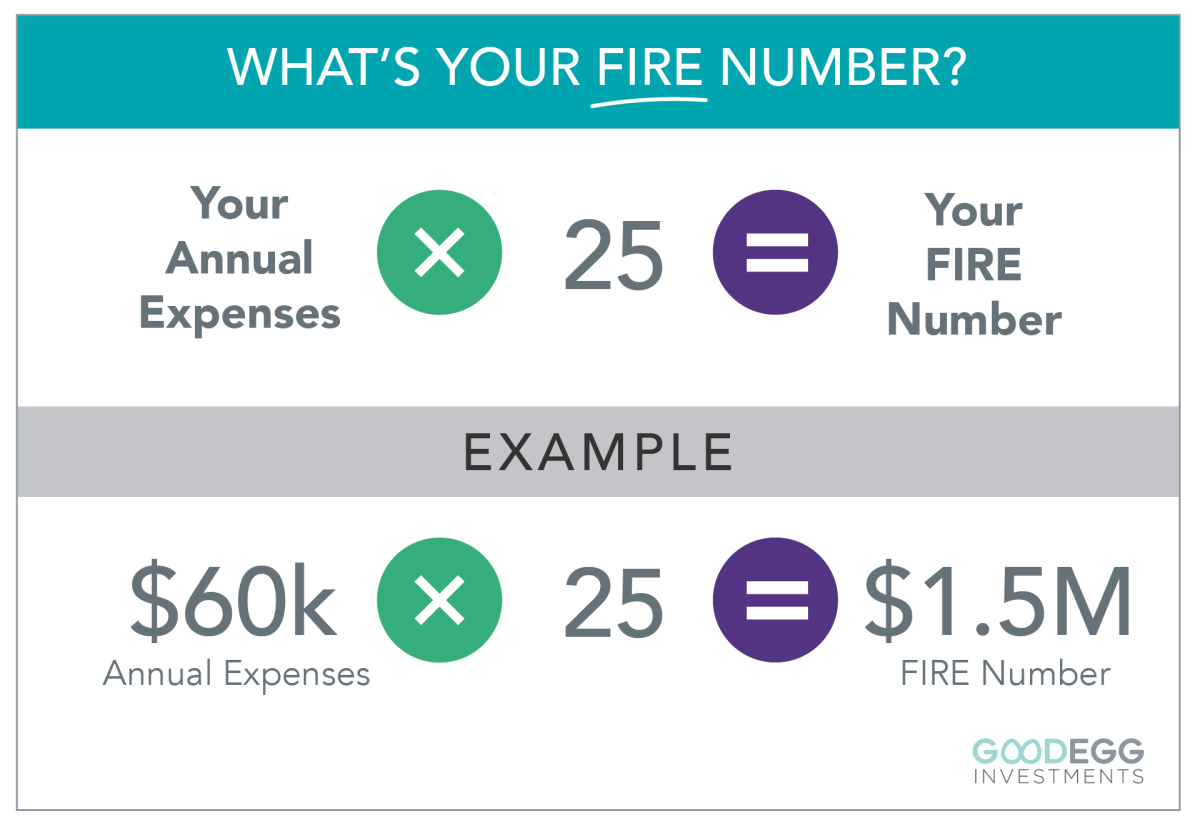

Determine Your FIRE Number – The Rule of 25

Once you find your FIRE number, you’ll know the total amount of money you need to have invested in order for the gains to cover your ongoing expenses.

To calculate your FIRE number, start by taking stock of your current expenses. Take a look at your expenses over the last year, as well as your expenses for this year, and make sure they’re fairly comparable.

To calculate your ballpark FIRE number, take your annual expenses number and multiply it by 25.

Annual Expenses x 25 = FIRE Number

For example, if you have $60,000 in annual expenses, your FIRE number would be $1.5 million.

$60,000 expenses x 25 = $1,500,000 FIRE number

Estimating Your Annual Returns

Please note that the rule of 25 assumes an annual return of 8%. In other words, if you had $1.5 million invested at an annual return of 8%, that means you would receive $120,000 in annual passive income, which would be enough to cover your expenses while also accounting for inflation.

$1,500,000 invested x 8% annual return = $120,000 in annual passive income

Of course, this $120,000 is greater than the $60,000 needed for your current expenses. This is so that you can account for inflation over time and still protect and grow your initial principal, so the annual returns stay at the same level or greater.

The 4% Rule

Now that you know how much you need to have invested, the other side of the FIRE coin is the amount you can safely withdraw each year, in order to preserve your investment even when accounting for inflation and shifts in the economy.

Based on a 1998 study done at Trinity University, the commonly recommended withdrawal rate is 4% per year. This 4% withdrawal rate ensures that, based on historical data, you can maintain your wealth and principal.

Conservative Variation – The Rule Of 33 With A 3% Withdrawal Rate

To be safe, especially given all the economic uncertainty of late, many within the FIRE community now recommend calculating your withdrawal rate based on 3% rather than 4%.

If you choose to use 3%, you’ll need to multiply your annual expenses by 33 (instead of 25) to determine your FIRE number.

How Long Will It Take To Achieve FIRE?

Once you’ve determined your FIRE number, the next question you might be thinking about is how long it will take you to reach financial independence and retire early.

After all, if you currently only have a few hundred thousand in savings and need $1.5 million in order to reach financial independence, that can seem completely overwhelming.

This is where you’ll need to take a closer look at your personal finances and determine how much you can save and invest each year.

Many who are on the financial independence, retire early journey make some short-term sacrifices for long-term gains. These sacrifices might involve living a more frugal lifestyle (thus decreasing your expenses) or investing more time to launch a side hustle or creating additional streams of income (thus increasing your income).

FIRE Journey Example

Let’s say that you currently make $100,000 per year, and your spouse makes $75,000. Your current expenses per year total $60,000, meaning your FIRE number based on the rule of 25 is $1.5 million.

After looking at your expenses and identifying some areas where you can scale back, you see that you can easily save $50,000 per year.

Assuming you are starting with $0 in savings and investments today, with an aim to get to a FIRE number of $1.5 million, it would take you 30 years to get to $1.5 million. Not ideal.

$1,500,000 FIRE number ➗$50,000 savings per year = 30 years

That’s not going to work, so then you take a closer look at your expenses and realize that, with some minor changes, you could save $75,000 per year.

$1,500,000 FIRE number ➗$75,000 savings per year = 20 years

That’s closer. And 20 years is definitely better than the traditional 40-year path to retirement. But let’s say you wanted to really step it up, and you figure out how to live on just your spouse’s income and save your full $100,000 in income.

$1,500,000 FIRE number ➗$100,000 savings per year = 15 years

Of course, that’s assuming that you don’t receive any raises during that time, that you’re not taking advantage of benefits that come with retirement savings, that you’re not utilizing tax efficient strategies, that you’re not receiving any returns from your investments during that time, and that you’re not factoring in the magic of compounding.

Each of those elements will play a major part in your path to financial freedom and could dramatically accelerate your path to FIRE.

Want to calculate your journey to FIRE with more accuracy? Check out the FIRE Age Calculator

Leveraging Retirement Accounts

Speaking of compounding, let’s take a moment to talk about retirement accounts – namely IRAs and 401(k)s. Saving and investing money in tax-advantaged retirement accounts can help you accelerate your wealth creation through both compound interest and tax benefits.

For a Roth IRA, you will pay taxes up front, but then after that, your investments grow tax-free, and your future withdrawals in retirement would be tax-free as well.

For traditional IRAs and 401(k)s, you don’t pay taxes up front, and your money grows tax-free and gives you compound interest, but you are subject to taxes when you withdraw money down the road.

Of course, there are annual contribution limits for both IRAs and 401(k)s, so once you’ve put in as much money as possible into retirement accounts, look into other high growth and tax advantaged investments, like real estate.

How To Accelerate Your Journey To FIRE Through Real Estate

In addition to finding ways to increase your income and lower your expenses, the investments you choose during your path to FIRE can also have a significant impact on the length of your journey.

For example, going back to the example of saving $50,000 per year, if you were to invest that $50,000 into a real estate syndication each year, with a 5-year hold and 2x equity multiple, that means you could roughly double your money from $50,000 to $100,000 every 5 years.

Through the power of strong returns (roughly 20% average annual returns in this example), plus the power of compounding, not to mention the tax benefits of cost segregation and bonus depreciation, suddenly your FIRE number becomes much more achievable.

Related: The Ultimate Beginner’s Guide To Investing In Real Estate

New To Passive Investing?

Sign up for our free Passive Real Estate Investing 101 course. You'll get 1 email a day for 7 days – everything you need to invest confidently in your first real estate syndication.

sign up now

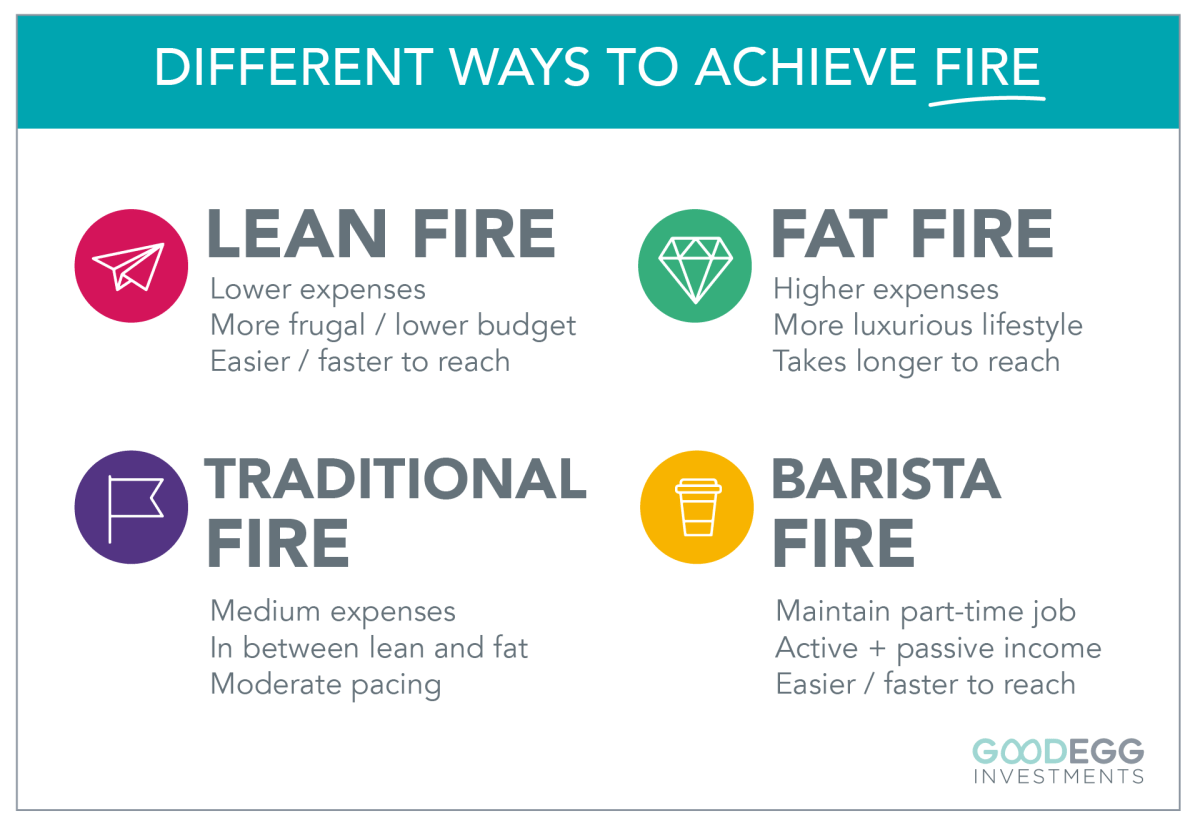

Types Of FIRE

Just like ice cream, there are many flavors of FIRE, and depending on your goals, lifestyle, and timeframe, you can choose the flavor of FIRE that best suits your needs.

FIRE can range from lean FIRE (more frugal lifestyle but faster to achieve) to fat FIRE (more luxurious lifestyle but longer to achieve).

Lean FIRE

If your goal is to get to FIRE as quickly as possible, Lean FIRE might be your flavor of choice. Typically, lean FIRE is best if you are willing to live on a bare-bones budget while achieving financial independence sooner.

If you choose the lean FIRE approach, your FIRE number could be $1 million or less, making it much more attainable and in a shorter amount of time.

In order to maintain a more frugal lifestyle, you’ll need to have more discipline and potentially bring in more creativity when it comes to your personal finances.

Traditional FIRE

If your goal is to maintain your current lifestyle, traditional FIRE might be the best fit for you. Traditional FIRE is based on your current expenses, so if you were to reach your traditional FIRE number, you would be able to maintain your current lifestyle.

If you’re willing to cut some corners, be strategic about your saving and investing, and are not in a huge rush to achieve financial independence and retire early, traditional FIRE might be a good path for you.

Fat FIRE

If, on the other hand, you want to be able to retire with a significant buffer to live the life you desire and potentially improve your lifestyle from what it is currently, fat FIRE might be the best fit for you.

This path typically assumes yearly expenses of $100,000 or more, meaning your fat FIRE number would be $2.5 million or more. While it could take longer to get to fat FIRE, leveraging strategic investments like real estate could accelerate your path to fat FIRE.

Barista FIRE

One more variation to throw into the mix is barista FIRE, which is a different type of FIRE lifestyle. If you’re not looking to retire completely but instead looking to be able to work part time, barista FIRE could be the best path for you.

To calculate your barista FIRE number, take your yearly expenses and subtract the amount you would make from the part time job that you would continue to work, then multiply by 25.

(Annual Expenses – Annual Income From Part-Time Job) x 25 = Barista FIRE Number

Strategies To Achieve Your FIRE Number

Your journey to FIRE is fluid and flexible. Based on the discipline and creativity you put in, you could drastically speed up your path to FIRE and thus attain freedom sooner than you might think.

FIRE Strategy #1 – Reduce Expenses

The easiest and fastest way to accelerate your path to your FIRE number is to reduce expenses. Your expenses are entirely within your control, making this the most effective way to achieve FIRE faster.

Start by taking a look at your expenses over the last 3 months. Even though it’s annoying, I highly recommend you print out all your credit card and bank statements.

Then, get some highlighters and start marking expenses that are necessary and ones that you could eliminate. You can use the highlighters to color-code the different types of expenses, to help you see the impact on your overall expense level.

Even reducing your expenses by 10% per year could make a significant difference in your timeline to achieve FIRE.

FIRE Strategy #2 – Increase Your Income

Another way to accelerate your path to FIRE is to increase your income. The simplest way to achieve this would be to ask for a raise.

Barring that, you could potentially take on a second job or a side hustle. For example, perhaps you could open up an Etsy store, do web design work on the weekends, or work part-time at a local business.

FIRE Strategy #3 – Invest Wisely

A great way to add jet fuel to your FIRE plan is to invest. However, not all investments are created equal. Some investments come with higher degrees of risk but offer higher potential returns in exchange. Others are lower risk but offer more conservative returns.

If you can find an investment with relatively low risk in combination with relatively high returns, that could significantly boost your path to FIRE.

Keep in mind that often, the biggest risk in an investment is your knowledge. In other words, if you invest time into learning about specific investment strategies, understanding the ins and outs of how they work, and connecting with key players within that investment world, you could significantly decrease your overall risk, because you would fully understand, and thus have more control over, the thing you’re investing in.

Related: How To Quit Your Job Through Investing In Real Estate

How To Get Started With FIRE

No one stumbles into FIRE by accident. If you’re looking to take decades off your timeline to retirement, you’ll need a plan, a healthy dose of creativity, and continued discipline and tracking along the way.

To get started, first take inventory of where you are. As mentioned above, start by deciding which type of FIRE is right for you (lean, fat, traditional, or barista).

Then, take a look at your expenses and calculate your FIRE number. This is your north star.

Work backwards to figure out how long it will take you to achieve your FIRE number, based on how much you can save and invest per year.

Then, sharpen your pencils and see where you can reduce expenses, increase income, or step up your investing game.

Next Steps

Given everything we just walked through, your head might be swimming right now with thoughts of becoming financially independent, starting your own FIRE journey, looking into tax-advantaged accounts, taking stock of your current personal finance hygiene, connecting with the FIRE community, or perhaps even finding a FIRE coach or connecting with a certified financial planner.

The most important thing is that you take action on something – anything – to kickstart your FIRE journey. So take a moment right now to choose 1-3 things that you can commit to today or within the next week to get started. Here are a few recommendations:

Figure out your total expenses per year

Choose the right FIRE path for you (lean, fat, traditional, or barista)

Determine your FIRE number

If you just complete those 3 steps, you’ll be well on your way to becoming financially independent.

And as you start educating yourself on the different strategies and investments you’ll use on your FIRE journey, know that we’re here to help.

Here at Goodegg Investments, we have a variety of options for you to help you learn about and invest in real estate to accelerate your path to FIRE, so you can take advantage of the cash flow, equity, appreciation, and tax benefits. Below are a few resources to get you started.

Invest Now

If you’re ready to invest right now, we invite you to check out our open deals page to learn more about our current or upcoming opportunities.

And if you’re an accredited investor, we invite you to join the Goodegg Investor Club, so you can invest alongside us in real estate syndications (group investments).

Learn More

If you’re not yet ready to invest but are curious about how all of this works, we invite you to dip your toe in the water with us through our free 7-day email course – Passive Real Estate Investing 101 – or to get a free hardcover copy of our book – Investing For Good.

Connect With Us

If there’s ever anything we can do to help you on your journey, feel free to email us at [email protected] or call / text us at (888) 830-1450.