I thought I’d never retire. It just wasn’t going to be possible.

Unfortunately, this mindset prevented me from even starting to move toward financial freedom for at least 10 years. So I get it when you’re just starting and think that amassing millions of dollars seems like an absolutely out-of-this-world idea.

But is possible for anyone to achieve. I firmly believe that now. If a simple raft guide, making less than $10k/yr and living for 6 months a year camping by the side of a river can start to ascend the steps to financial freedom, then so can you.

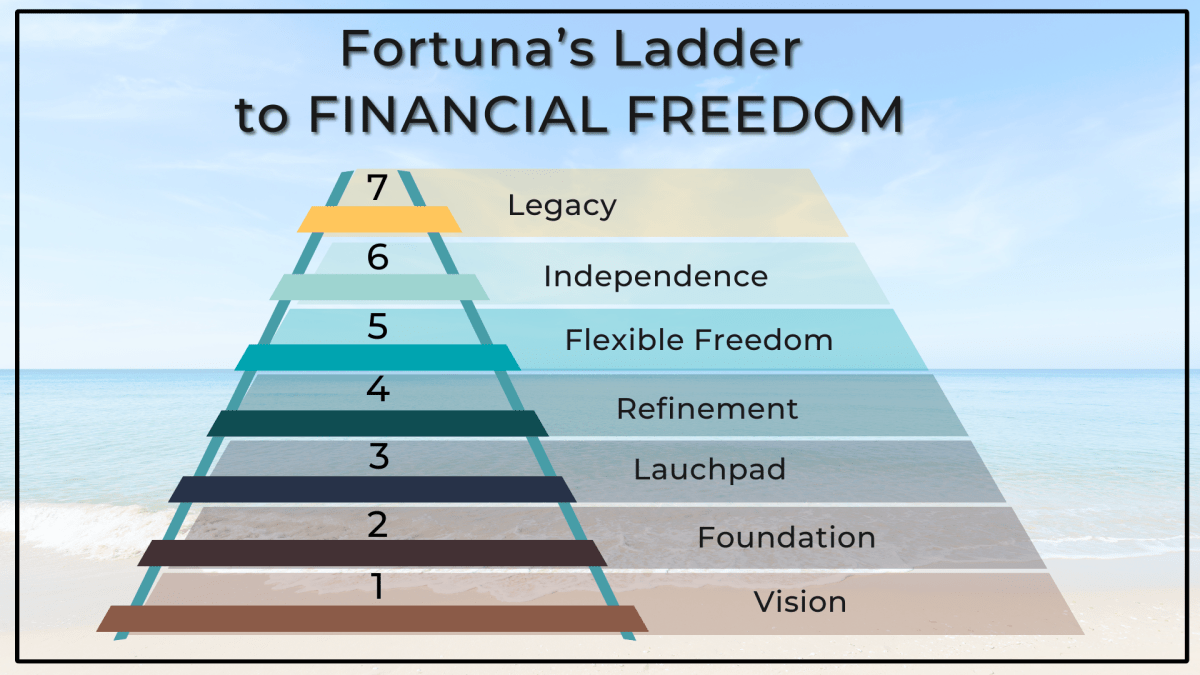

Now, just 5 years after first learning about financial freedom, I’m nearly on step #5. Soon enough I’ll be looking at the world from step #7 and trying to help assist more people up that ladder.

You can navigate from financial uncertainty to ultimate wealth with the 7 levels of financial freedom. This guide can help make it feel more tangible. More possible. I’ll show how each level contributes to your financial growth, tangible tools, and personal peace of mind. Straightforward and without fluff, get ready to transform your approach to finances and begin your ascent up Fortuna’s Ladder to financial prosperity today.

Key Takeaways

-

Financial freedom is reached through incremental levels, starting from getting financial clarity and setting goals, then moving toward self-sufficiency, and ultimately achieving the ability to live off passive income and abundant wealth.

-

Key strategies in ascending the levels include budgeting, eliminating debt, building emergency funds, increasing income, optimizing expenses, investing smartly, and diversifying investments.

-

Reaching the pinnacle of financial freedom allows for living a dream lifestyle and giving generously, illustrating the importance of managing finance with purpose and planning for a lasting legacy.

Why Financial Freedom?

In today’s hyperconnected, digitally-driven, and rapidly changing world achieving financial freedom is not just a lofty goal but a necessity. We need to take our future into our own hands, so that we can bring the most good to the world possible.

It’s about more than just accumulating wealth. It’s about gaining the freedom to live life on your terms, free from financial stress and constraints.

Just as Grant Sabatier notes in his book “Financial Freedom,” this journey isn’t about being rich; it’s about living richer. It’s about being part of the FIRE movement (Financial Independence, Retire Early), where you set long-term financial goals and strategize to achieve them, eventually reaching a point where your rent covers more than just your living expenses. And it’s about living your own life by design, not by default, along the way.

The objective is to construct a life where money serves as a tool rather than a constraint.

Related Article: Financial Freedom vs. Financial Independence: How They’re Different, And How You Can Get There

New To Passive Investing?

Sign up for our free Passive Real Estate Investing 101 course. You'll get 1 email a day for 7 days – everything you need to invest confidently in your first real estate syndication.

sign up nowFortuna’s Ladder to Financial Freedom Level 1: Clarifying Your Vision of Financial Independence

Imagine a ship setting sail without a destination. It’s likely to be tossed around by the waves and winds, right? The same is true for your financial journey.

But just like that ship, the destination may change over time. Sure, French Polynesia sounds great when you start your round-the-world sailing adventure, but you may get stalled out in the Mediterranean and pivot to a European RV tour. Hey, it could happen.

The initial stage of financial freedom involves:

- Gaining financial clarity

- Comprehensive evaluation of your personal finances

- Establishing financial goals

- Formulating a budget (or not, more on that below)

The aim is to comprehend your current financial position and chart a course to your desired destination. Think of it as setting the coordinates for your financial ship, giving it a clear direction to sail towards.

Assessing Your Finances

You can’t begin a journey without knowing your starting point, and the journey to financial independence is no different. It begins with assessing your finances. This involves:

- Conducting a financial audit to track both your fixed and variable expenses

- Enhancing your financial literacy to make informed decisions

- Developing a habit of regularly tracking your financial progress

Think of it as a medical check-up, but for your finances. You’re getting a clear financial picture of your financial health, understanding the state of your cash flow, and identifying areas that need attention. This step is crucial as it lays the foundation for your financial stability.

Don’t judge yourself here. Just write it all down. If there are expenses that make you cringe, know that are working toward either not making the same decision again or being able to afford those luxuries with ease.

Setting Financial Goals

With a lucid understanding of your financial condition, the next step is to determine your financial objectives or long-term financial goals. These are the destinations you want your financial ship to reach. Your goals could be anything from saving for a dream vacation, buying a home, or planning for retirement. The key is to make your goals specific, measurable, and time-bound. This approach not only creates a sense of urgency but also provides a clear plan for achievement.

Bear in mind, these objectives serve as your compass, steering your financial journey and providing motivation to persist.

Creating a Budget

This is my least favorite step. I’ll tell you why after I present the reasons for doing this.

Imagine trying to stay within the speed limit without a speedometer. Sounds challenging, right? That’s what trying to manage your finances without a budget is like. A budget functions akin to a financial speedometer. It aids in monitoring your income and expenses, helping to prevent overspending and ensure alignment with your financial objectives.

It involves listing all your monthly expenses and projecting how much you can spend in each category. Then, you’ll verify them by reviewing bank and credit card statements from previous months. Regularly reviewing your budget helps you stay on track and make adjustments as necessary. Remember, a budget isn’t about restricting your spending; it’s about understanding and managing it.

I don’t like them because I have found that budgets require a level of time and scrutiny that I simply don’t have. However, I’m not a chronic over-spender (my upbringing and scarring from a money-scarce house did me well there I guess), so I don’t naturally spend way more than I make.

That being said, I do go back and look at my expenses every few months to see if my general feelings about how much I’m spending match with my reality. Do what works for you, but find a way to analyze your regular spending habits.

Fortuna’s Ladder to Financial Freedom Level 2: Foundation of Self-Sufficiency

Armed with a clear financial outlook, the next phase is to achieve self-sufficiency on your way to reach financial independence. This stage is all about standing on your own two feet financially. It’s composed of three essential thresholds:

Earning enough to cover all your expenses without relying on external financial help. Think of it as learning to swim. At first, you might need floaties or a lifeguard to keep you afloat. But with time and practice, you learn to swim on your own, becoming one of those financially independent folks.

Establishing an emergency fund. This is part of the essential foundation of financial security, because you never when what can happen to your paycheck. The construction of an emergency fund functions as your financial safety net, ensuring you have enough money during unforeseen circumstances.

Eliminating debt. You’ll want to get to the point where you aren’t paying to borrow money (except for your primary residence, likely). The attainment of personal finance self-sufficiency requires debt elimination.

Building an Emergency Fund

An emergency fund resembles a lifeboat for your financial vessel. It’s a buffer against unexpected expenses like unplanned medical bills or job losses. Building an emergency fund involves making small savings contributions and using windfalls such as tax refunds or bonuses.

The size of the fund should be tailored to your needs, typically covering around three to six months’ expenses. Remember, an emergency fund isn’t just a safety net; it’s a peace of mind fund. It’s there to ensure that even in the face of financial storms, your ship stays afloat. It’s the rebar in your foundation.

Eliminating Debt

Debt is like a leak in your financial ship. It can slow you down and, if left unchecked, can even sink your ship. That’s why eliminating debt, including credit card debt, is a crucial part of achieving financial security. This involves formulating a plan to pay off high-interest debt, such as credit cards.

Strategies like the snowball method, where you pay off the smallest balance first before moving on to the next, can create momentum and psychological wins. It’s about taking control of your financial situation and steering your ship away from the stormy waters of debt.

Fortuna’s Ladder to Financial Freedom Level 3: Stepping Up And Taking Your Financial Independence To New Heights

With the establishment of a firm foundation, the subsequent phase is to ascend to the launchpad. This stage is all about:

- Gaining financial breathing room

- Increasing your income

- Optimizing your expenses

- Starting to invest

Think of it as filling up your ship’s fuel tank, checking the engines, and preparing for launch. You’re getting ready to take your financial journey to new heights.

Increasing Your Financial Income

Fueling your financial ship involves increasing your income. But now that you aren’t paying debt, this gets easier and easier.

This could involve advancing in your career, selling personal items, or renting out unused assets. Each of these strategies can supplement your income, contributing to the forward momentum of your financial journey.

But remember, earning more doesn’t mean having more. It’s also about managing your income effectively and directing it towards your financial goals. This is where you need to be super careful to not let non-intentional lifestyle creep come in. For instance, Ramit Sethi, author of I Will Teach You To Be Rich suggests putting 25% of every raise into a “celebration” bucket, and investing the remaining 75%.

Related Podcast: Unconventional Passive Income Tactics to Fuel Your Real Estate Ambitions

Optimizing Expenses

While fuelling your financial journey, it’s equally vital to streamline your expenses. This involves creating a more refined budget, eliminating unnecessary costs, and adopting money-saving habits. By doing so, you’ll have living expenses saved, which can be thought of as streamlining your ship, reducing drag, and ensuring efficient use of your fuel.

Starting to Invest

As your financial ship gains momentum, it’s time to start investing. Investing is like adding rocket boosters to your ship. It’s about putting your money to work for you, generating passive income, and growing your wealth over time.

Commencing investments early and utilizing tax-advantaged savings and investment accounts can facilitate exponential growth of your wealth.

It is essential to start investing as soon as possible, so don’t skip this step!

Start Real Estate Investing Early

One of the powerful rocket boosters you can add to your financial ship is real estate investing. By starting real estate investing early, you can create a passive income stream that grows alongside your career income.

Whether through crowdfunding platforms or rental properties, real estate can be a key engine of financial growth.

Check Out Our Open Investments

Want to invest alongside us? Take a look at some of our current and upcoming offerings.

see open dealsFortuna’s Ladder to Financial Freedom Level 4: Refining Your Financial And Investment Strategy

Now that your financial journey is underway, the next step involves refining your financial strategy. This is the fourth level of the 7 levels of financial freedom, where you calculate your FI number, diversify your investments, and plan for unexpected events. It’s about fine-tuning your financial ship’s course, ensuring it’s set for the right destination.

Calculate Your Financial Independence (FI) Number

Your Financial Independence number (FI number) is the amount of wealth you need to have invested to live off the passive income indefinitely. For stock market index fund investors, this is found by taking your annual expenses and multiplying by 25. You could pull 4% of that number every year without depleting your principal to zero.

For real estate investments, your FI number may be when the cash flow is enough to cover your current living expenses. Because you’ll be reinvesting the proceeds and original capital with every asset sale, you’re wealth will continue to grow (fast), allowing you to have more and more cash flow every year.

Related Video: Just 5-years To Build A Lifetime of Wealth: Here’s How

Diversifying Investments

Diversification can be likened to having multiple engines propelling your financial journey. It’s about spreading your investments across various asset classes to reduce risk and provide more stable returns over time.

Whether it’s real estate, equity stakes, or bonds, diversification in your investment portfolio can help smooth out your financial journey.

Planning for Unexpected Events

As you sail towards your financial destination, you need to plan for unexpected events. This involves having insurance policies in place to protect you from large, unforeseen expenses. It’s about preparing for the unknown storms that might come your way, ensuring your financial ship remains resilient.

Fortuna’s Ladder to Financial Freedom Level 5: Financial Flexibility

Upon reaching the fifth stage of financial freedom, you start to enjoy financial flexibility. This is when your passive income starts to cover a significant portion of your living expenses, allowing you to explore new ventures and even take periods of rest.

It’s like reaching a safe harbor where you can take a break, replenish your supplies, and prepare for the next leg of your journey.

This stage is reached when you have 50% of your expenses covered by your investments.

Alternative Income Streams

At this stage, you may have the opportunity to explore alternative income streams that could support you into retirement, beyond just portfolio income. These can include starting a side business, or other passive income opportunities. This is the time to play with some of your dream ideas while also helping to pay your living expenses.

Each new income stream, contributing to your annual income, is like a fresh gust of wind, propelling your financial ship further along its course and helping you break free from living paycheck to paycheck.

Lifestyle Changes

Achieving financial flexibility also involves making lifestyle changes. This may mean embracing simplicity or exploring creative living arrangements. Each change is like adjusting your sails, catching the wind more efficiently, and speeding up your financial journey.

Related Article: House Hacking 101 – How To Live For Free Through House Hacking

Check Out Our Track Record Of Success

Curious whether we can actually do what we say we're going to do? Compare projected versus actual returns in all the deals we've exited to date.

download track recordFortuna’s Ladder to Financial Freedom Level 6: Elevate to Financial Independence

Upon departing the safe harbor of financial flexibility, you are prepared to ascend to the ensuing level: financial independence. At this level, you reach a point where you can live solely off the income generated from your investments, passive real estate investments, or rental properties. It’s like reaching the open sea, where you’re free to sail in any direction you choose, having achieved financial independence.

This is one of the higher levels of financial freedom that many aspire to attain, and understanding the levels of financial freedom can help guide your journey. You may choose to quit your job or take on a passion project.

Smart Investing

Navigating the open sea requires smart investing. This involves:

- Refining your investment strategy to generate portfolio income

- Making sure each investment serves its intended strategic purpose

- Steering your financial ship with precision and expertise, ensuring it stays on course.

Passive Income

In the open sea of financial independence, passive income becomes a significant reliance. This income stream is like a constant wind, steadily pushing your financial ship forward. Whether it’s from rental properties, crowdfunded real estate platforms, or other investments, passive income is key to sustaining your journey towards financial independence.

Disciplined Spending

In the vast expanse of the open sea, resources are finite, underscoring the necessity for disciplined spending. It’s about managing your resources wisely, ensuring you have enough to last the journey.

Whether it’s adopting a frugal mindset or distinguishing between needs and wants, disciplined spending is key to navigating the open sea of financial independence.

Fortuna’s Ladder to Financial Freedom Level 7: Legacy and Attaining Abundant Wealth

Ultimately, you arrive at the pinnacle of financial freedom: abundant wealth and a lasting legacy. Here, you have more money than you may ever need, effectively eliminating financial concerns from your life. It’s like reaching a tropical paradise, where you’re free to enjoy the fruits of your labor and live life on your own terms.

However, you may find at this stage that money doesn’t actually buy happiness. Here’s where the true happiness can unlock, when we explore what it means to live intentionally and what brings us the most meaning.

Living Your Dream Lifestyle

In this blissful utopia, you have the liberty to lead your dream lifestyle. This could involve traveling to exotic locations, spending quality time with loved ones, or pursuing personal passions. It’s about enjoying the journey and the destination, living a life that truly reflects your values and interests.

Giving Generously

With abundant wealth, you’re also free to give generously. Whether it’s donating to causes you care about, tipping generously, or participating in community service, giving back is a way to share the fruits of your labor with others. It’s about making a positive impact and leaving a legacy that lasts beyond your journey.

Frequently Asked Questions

What are the seven levels of financial freedom?

The seven levels of financial freedom start with clarity and build to abundant wealth. It’s a journey that takes time and commitment.

What are the stages of financial freedom?

Financial freedom can be broken down into stages, such as building an emergency fund, paying off debts, and growing investments. It’s a journey that requires patience and discipline.

Want To Invest With Us?

You're invited! Join the Goodegg Investor Club to get access to our open investments and to stay in the loop on upcoming opportunities.

join now